A global report released by Ripple Labs titled “New Value: Crypto Trends In Business & Beyond” found that over 76% of financial institutions throughout the world intend to utilize cryptocurrencies within the next 3 years.

The report focuses on “the role of key blockchain use cases like payments and DeFi, and the token types — often referred to as “digital assets” — for those use cases, including cryptocurrencies, central bank digital currencies (CBDCs), non-fungible-tokens (NFTs), and more.”

Institutional Adoption Of Crypto And Blockchain

The biggest point of adoption is as a payment method, with over 70% of global financial institutions interested in using blockchain for payments – this includes both centralized and decentralized coins. Making payments was listed as the number 1 reason to hold crypto with 1/3 (33%) of global consumers considering crypto as a payment method.

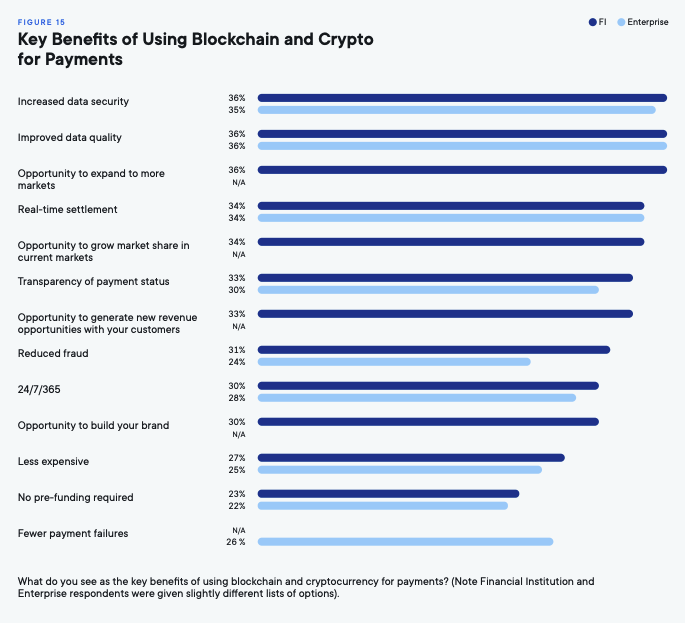

When institutions and enterprises were asked what they believe to be the key benefits of adopting blockchain and cryptocurrencies for payments, the answers showed a broad range of benefits with data security and quality taking first place. Behind that were market expansion, real-time settlement, and transparency.

Adopting crypto as a payment method also solves various compliance issues such as crime identification, payment transparency, know-your-customer (KYC), payment tracking, and efficiency while saving time and money, enhanced compliance and security while being less complex than traditional payment methods.

Using crypto as a method of payment seems to be in the foresight of many financial institutions around the world. The lack of understanding about how it all works, the insufficient tools to comply with blockchain, and the cloudy regulations are the bridges that still need to be crossed by these organizations.