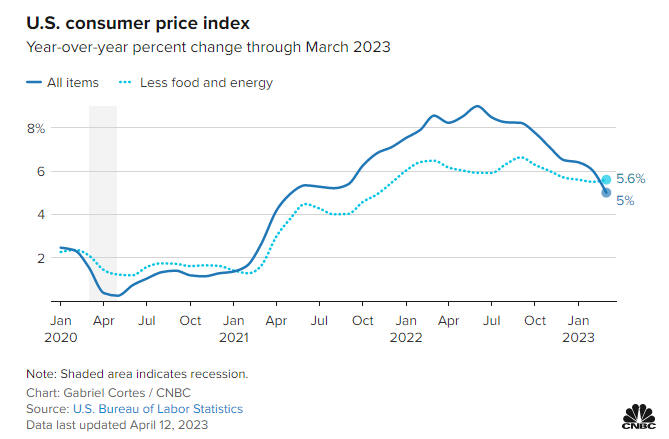

The U.S. economy remains stable for now, and according to the official data that was released this Wednesday, the Consumer price index (CPI) increased in March at a slower-than-expected pace. The report showed the prices urban consumers pay for a basket of goods and services rose by 0.1% from February and 5.0% year-on-year, landing below consensus expectations of 0.2% and 5.2%.

However, the core measure that strips out volatile food and energy prices posted a monthly gain of 0.4% and 5.6% on an annual basis. Peter Cardillo, a chief market economist at Spartan Capital Securities in New York, said:

“The topline is good news, but the core is still elevated. Inflation is going in the right direction, but the fact that core remains stubbornly high suggests that the Fed is likely to raise interest rates by 25 basis points in May.”

Inflation remains far above the Fed’s target; the path to 2% will be bumpy, and because of this, economists are worried that an aggressive Federal Reserve will push the economy into a recession that could dent corporate earnings and stock markets. It is important to mention that the U.S. Central Bank raised interest rates again in March despite the banking crisis, and the main question still remains how much time Fed will need to hold policy at a restrictive level in order to control inflation?

The federal funds rate is now in a range of 4.75% to 5%, which is the highest level since 2006 year and a recommendation is that investors should continue to take a defensive investment approach in the second quarter of 2023. With higher interest rates, companies need to spend more money to borrow money to invest in growth, and historically, higher rates lead companies to pull back on spending (and especially on hiring).

The U.S. economy ended 2022 year on a slightly softer footing, and analysts expect that the U.S. economy should expand by somewhere close to 1% in each of the next two years, which is roughly half the pace of growth seen in 2022. Despite this, the stock market experienced a robust rebound in the first three months of the 2023 year; still, many companies continue to see a decline in key financials, with earnings expected to slide in the upcoming quarters of 2023. There is an expectation that we could see a meaningful slowdown in economic growth and a weakening of the labor market in the United States, and if earnings growth continues to fall short of expectations, the stock market’s reaction could be severe.