Investors continue to watch carefully comments from Federal Reserve officials that could give more insight into the path of interest rates, but it is important to say that the U.S. central bank is widely seen raising rates by 25 basis points next month. The latest economic data, including retail sales, industrial production, and consumer sentiment, cemented this expectation, and according to analysts, the U.S. economy still has some vibrancy, which gives the Fed cover to continue its rate hike policy in May.

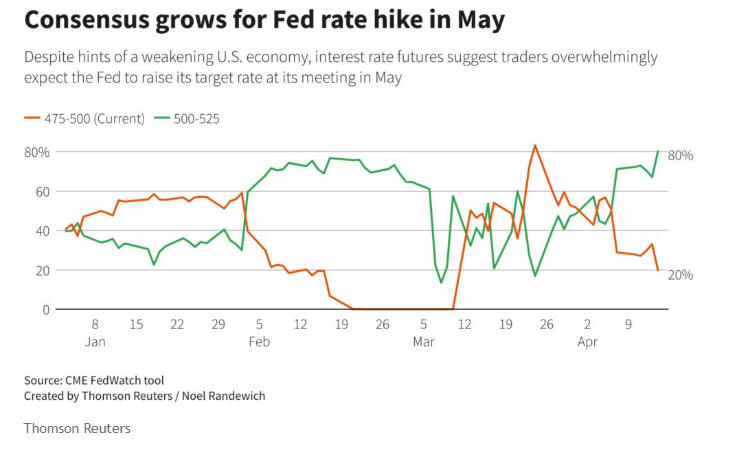

At last glance, financial markets have priced in an 80% likelihood of that happening, and it is still not sure when the central bank would pause its monetary policy tightening. Because of this, economists are worried that an aggressive Federal Reserve will push the economy into a recession, and according to the famous investor Jeremy Grantham, the U.S. stock market could experience significant losses over the coming months. The federal funds rate is now in a range of 4.75% to 5%, which is the highest level since the 2006 year, and a recommendation is that investors should continue to take a defensive investment approach in the upcoming weeks.

Corporate profits are emerging as the big driver of what the market is likely to do in the near term, and according to Refinitiv IBES data, S&P 500 company earnings are expected to have declined 4.8% in the first quarter compared with the same period last year. The second quarter could be an even worst story, and Steven Blitz, a chief U.S. economist at TS Lombard, said that he expects negative growth in Q2, with recession to start by mid-year.

The recent collapse of Silicon Valley Bank was partly triggered by losses on its bond holdings as interest rates jumped and prices of U.S. government debt fell. Jeremy Grantham warned that the turmoil that swept through the banking sector last month is just the beginning. Jeremy Grantham made his name predicting the dot-com crash in 2000 and the financial crisis in 2008, and he is now warning:

See Related: Signature Bank Closed By New York Regulators; Another Big Blow to Crypto Investors

“Another epic bubble in financial markets is bursting. The best we can hope for is a fall of about 27% from current levels, while the worst-case scenario would see a plunge of more than 50%.”

Cryptocurrencies, Bonds, Real Estate Are Collateral

Stocks aren’t the only assets that significantly lost value when expensive money scared investors to avoid risks. The prices of government bonds and real estate were also shot down, and cryptocurrencies will not certainly be in the situation to escape a fall. The crypto market displayed a high correlation with U.S. equities. If a downtrend is witnessed in the stock market, the same is usually replicated in the crypto-sphere as well.

To put it short, if we see turmoil in the traditional financial markets, all other markets will feel turbulence.