U.S. stocks have primarily held steady through the start of the earnings season on stronger-than-expected results from big banks, but investors will continue to observe a host of earnings from mega-cap companies over the next two weeks.

It is important to say that of the 90 S&P 500 companies that have reported first-quarter results so far, more than 75% of them have topped analysts’ estimates. According to the latest Refinitiv IBES data, earnings forecasts have improved, and analysts expect a quarterly profit contraction of 4.7% compared with a 5.1% decline estimated at the start of April.

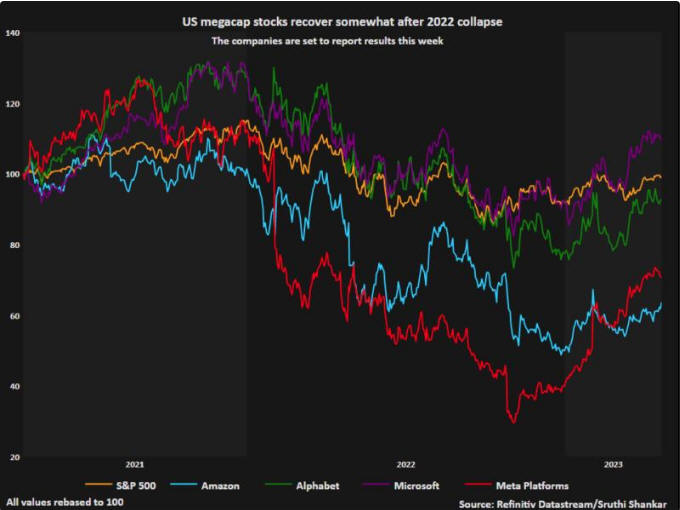

Microsoft, Visa, Alphabet (Google), Boing, Meta Platforms, Mastercard, Caterpillar, Activision Blizzard, Amazon, Gilead Sciences, Intel, Pinterest, Chevron, and Exxon Mobil are among the companies scheduled to report quarterly results this trading week. A positive performance among many of these stocks has supported Wall Street this year, so investors are worried about whether the gains can continue given the gloomy economic outlook.

Alphabet, Microsoft Corp, Amazon, and Meta Platforms constitute more than 14% of the value of the benchmark S&P 500, and investors will watch guidance carefully from these companies to determine if inflation will crimp profit margins or if costs can be passed through. Corporate profits are emerging as the big driver of what the market is likely to do in the near term, and if earnings results fall short of expectations, the stock market’s reaction could be severe. Peter Cardillo, chief market economist at Spartan Capital Securities in New York, said:

“It’s a make or break week for (tech) stocks; if earnings don’t disappoint, then the market can continue to rally.”

In the days ahead, the U.S. stock market will also be hypersensitive to any FED comments, while money market traders are currently pricing in a 92% chance that the U.S. central bank will raise rates by 25 basis points next month. The federal funds rate is now in a range of 4.75% to 5%, which is the highest level since 2006, and with higher interest rates, companies need to spend more money to borrow money to invest in growth, and historically, higher rates negatively influenced on companies’ earnings.

The latest economic data, including retail sales, industrial production, and consumer sentiment, probably cemented this expectation, and important data scheduled for release this week include early readings of first-quarter U.S. GDP, personal consumer expenditure index (PCE) for March, and April consumer confidence data.