In a press release, MicroStrategy, the business intelligence and mobile software company, has announced its first-quarter 2023 financial results.

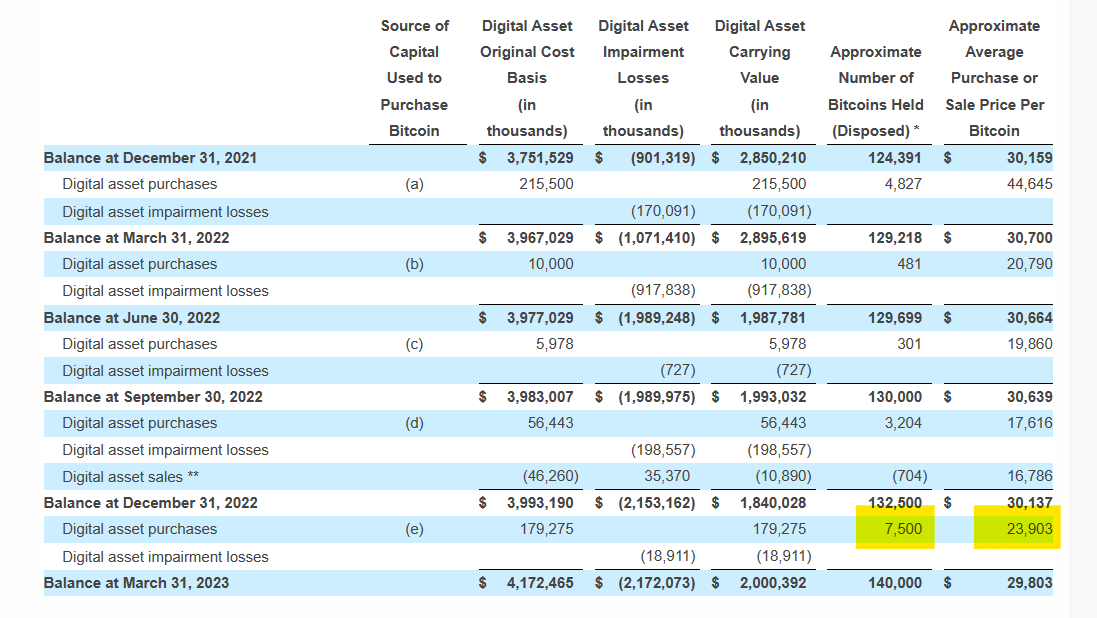

The company added 7,500 bitcoins in Q1 with an average price of $23,903, strengthening its balance sheet strategically. With this acquisition, the company’s holdings now total 140,000 BTC with an average price of $29,803.

As of March 31, 2023, MicroStrategy’s digital asset value falls to $2.00 billion with an impairment loss of $2.172 billion.

“Our goals for the enterprise analytics software business remain to grow our revenues and transition that business to the cloud while rigorously managing costs and strengthening margin as we focus on product innovation and winning market share,” said Andrew Kang, the company’s Chief Financial Officer.

“Furthermore, we are extremely excited to return to an in-person MicroStrategy World, showcasing the competitive advantages of our MicroStrategy One platform and highlighting the key areas of product innovation that will carry MicroStrategy into the future,” said Phong Le, President and Chief Executive Officer.

MicroStrategy And Bitcoin

MicroStrategy is a publicly traded company that provides business intelligence, mobile software, and cloud-based services. In recent years, MicroStrategy has become well-known for its involvement in digital asset investments. The company made Bitcoin its primary treasury reserve asset with an initial $250 million investment in August 2020. The company has continued to purchase BTC as part of its capital allocation strategy, now holding 140,000 BTC as of Q1 2023.