- The British government is considering issuing a digital version of the pound, known as the digital pound or Britcoin, to keep pace with the rapidly evolving financial landscape.

- The move would enable the government to offer citizens an alternative payment method in addition to cash, which is still widely used.

The Bank of England and the finance ministry launched a public consultation in February this year to explore the possibility of issuing a central bank digital currency (CBDC). Over time, the idea has gained considerable traction as, according to consultant PwC, more than 80% of the world’s central banks are considering the launch of digital currencies.

Here Are The Key Details Around The Digital Pound

What Is The Digital Pound?

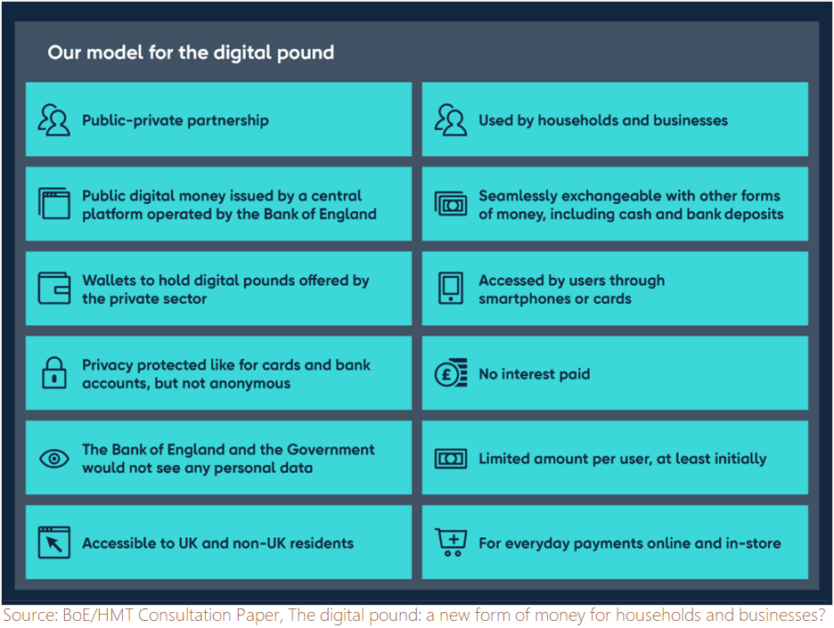

The digital pound is a type of CBDC, a digital version of sterling issued by the Bank of England. It is designed for use by everyone for day-to-day transactions, just like cash that can be used to make purchases online or in-store.

The digital pound is not a cryptocurrency or a cryptoasset. Unlike cryptocurrencies, which are issued privately, the digital pound would be issued by the Bank of England and backed by the government. Its value would be stable and equivalent to a physical currency note.

Why Is Britain Considering The Digital Pound?

The move is seen as a way for Britain to keep up with the global trend of digital currencies and maintain its status as a leading financial centre. According to the Director of the Number 10 Policy Unit, Andrew Griffith, Britain must not be left behind by global innovation in payments, with non-cash payments already accounting for 85% of payments and still growing.

What Are The Benefits Of The Digital Pound?

A digital pound would offer a new way to pay that is trusted, accessible, and easy to use. It would provide a secure and efficient payment method to use globally. Additionally, it could help to reduce the cost and time required for transactions, leading to increased efficiency in the economy.

Will The Digital Pound Replace Cash?

The digital pound is not intended to replace cash. The government recognizes that cash is important to many people and will continue to issue banknotes as long as they demand them.

Moving towards CBDC is an exciting development for the UK economy, offering a secure and efficient payment method for the digital age. While it won’t replace cash anytime soon, it could provide an alternative for those who prefer digital transactions and a host of potential benefits, including faster and cheaper payments, increased security, and increased convenience. However, some challenges must be addressed before the digital pound can be successfully introduced, such as the need for new technology and regulation.

As more countries consider launching their own digital currencies, the digital pound may help solidify Britain’s position as a leader in financial innovation.