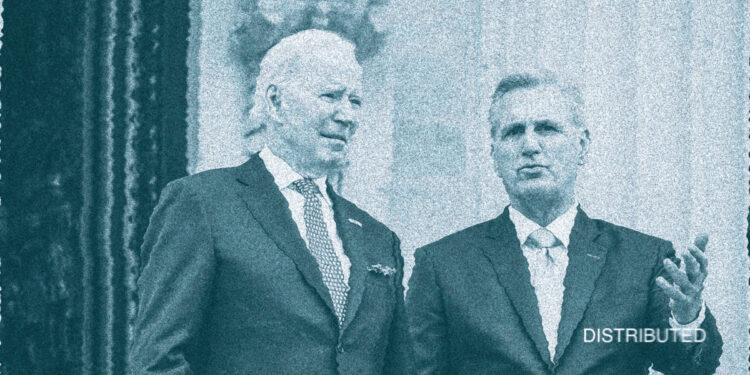

U.S. President Joe Biden and Republican House of Representatives Speaker Kevin McCarthy on Sunday signed off on an agreement to temporarily suspend the debt ceiling, which is a near-term positive for financial markets. Michael James, managing director at Wedbush Securities, said there’s certainly an exhale of relief that something has been done. However, Congress must still approve a package to avoid a U.S. default.

However, some analysts are warning that a negative consequence of the deal may be that investors who had held off on transferring bank deposits to money funds on concerns about a default may now make a move, which could have negative implications for the economy. Brian Reynolds, chief market strategist at Reynolds Strategy, said:

“Investors have been pulling bank deposits on concerns about the resilience of the regional banking system after Silicon Valley Bank collapsed, and the debt ceiling agreement may make it worse. As money market funds now are largely limited to investing in T-Bills and Fed repo, the shift away from deposits means less lending for consumers and businesses.”

Brian Reynolds may have it right, but it is important to remember that a default on government debt could leave millions of Americans without income payments, potentially triggering a recession that could destroy many American jobs and businesses. Economists and analysts expect Congress to approve a package to avoid a U.S. default. Still, they also said that we could see a meaningful slowdown in economic growth and a weakening of the labour market in the United States.

The jobs report on Friday is the next big test that could show if the economy is still resilient as higher rates crimp company credit lines. With higher interest rates, companies need to spend more money to borrow money to invest in growth, and historically, higher rates lead companies to pull back on spending (especially on hiring).

The famous investor Jeremy Grantham warned that the U.S. stock market could experience significant losses soon, and investors should keep in mind that cryptocurrencies could also be in the situation to make an even bigger fall. The crypto market displayed a high correlation with U.S. equities. If a downtrend is witnessed in the stock market, the same is usually replicated in the crypto-sphere as well.