The U.S. stock market recovered this Tuesday from recent losses as upbeat economic data cooled investor worries of a possible recession that could be triggered by the Federal Reserve’s aggressive interest rate hikes. In May, the U.S. economy showed positive signs, with higher-than-expected orders for essential capital goods and a significant increase in sales of new single-family homes. Moreover, consumer confidence in the U.S. reached its highest level since January 2022.

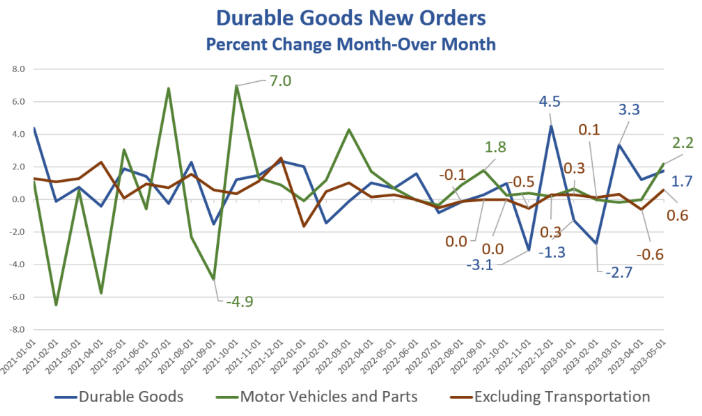

The Commerce Department’s durable goods report brought good news for analysts in May. Commercial aircraft/parts saw a significant rise of 32.5%, transportation equipment increased by 3.9%, and autos/features grew by 2.2%, leading to new orders. Non-defense capital goods, excluding aircraft, grew by 0.7%. The report indicates greater confidence in future business conditions and job availability for six months. Oren Klachkin, lead U.S. economist at Oxford Economics (OE), said:

“The May durable goods orders and shipments data help to fend off fears that a recession is just around the corner. However, the economic backdrop is set to become more discouraging for manufacturers as tighter lending standards and elevated interest rates weaken demand for goods.”

The U.S. economy remains steady despite the federal funds rate reaching its peak since 2007. Investors should note that good economic data may lead to a 25 basis point increase in interest rates at the Federal Reserve’s July meeting. Financial markets predict a 79.4% chance of this happening. This week’s important economic data includes a crucial inflation measure that could provide valuable insight into the Federal Reserve’s plans.

Experts recommend a cautious approach when interest rates exceed 5%. This involves taking calculated risks due to the current economic climate, which is unstable and unpredictable. As interest rates increase, companies face higher borrowing costs, causing them to decrease spending, especially on hiring.

Investor Jeremy Grantham warns of potential losses in the U.S. stock market and advises cautiousness. It’s important to note that cryptocurrencies could also face a significant decline. This is due to the high correlation between the crypto market and U.S. equities. If the stock market experiences a downturn, the crypto-sphere may follow suit. Investors must consider this possibility.