Despite the high federal funds rate, durable goods orders exceeded expectations, which caused investors to remain unconcerned about a recession, surprising analysts.

On March 12, the central bank’s bank term funding program announcement reinforced faith in the banking system, and investors were content to see additional signs of decreased inflation. The stock market tracked with the economy in the first half of 2023, surprising the upside and leaving investors to wonder if the resilience can continue. The current rally in the cryptocurrency market is also connected with the positive sentiment on the stock markets, and the strengthening correlation between crypto prices and stock prices indicates crypto’s maturity. Bank of America U.S. economist Michael Gapen said on Friday:

“The economy has proven more resilient than we previously expected, owing largely to consumption. However, we do not expect such robust prints to continue. Momentum in the economy should slow as the lagged effects of tighter monetary policy and financial conditions start to take hold.”

The jobs report on Friday is the next big test that could show if the economy is still resilient as higher rates crimp company credit lines. Companies must pay more to borrow when interest rates rise, causing them to decrease spending and job opportunities. According to analysts’ estimates, the job report on Friday could show that the U.S. economy added 225,000 jobs in June 2023, with the unemployment rate set to fall to 3.6%, down from 3.7% in May.

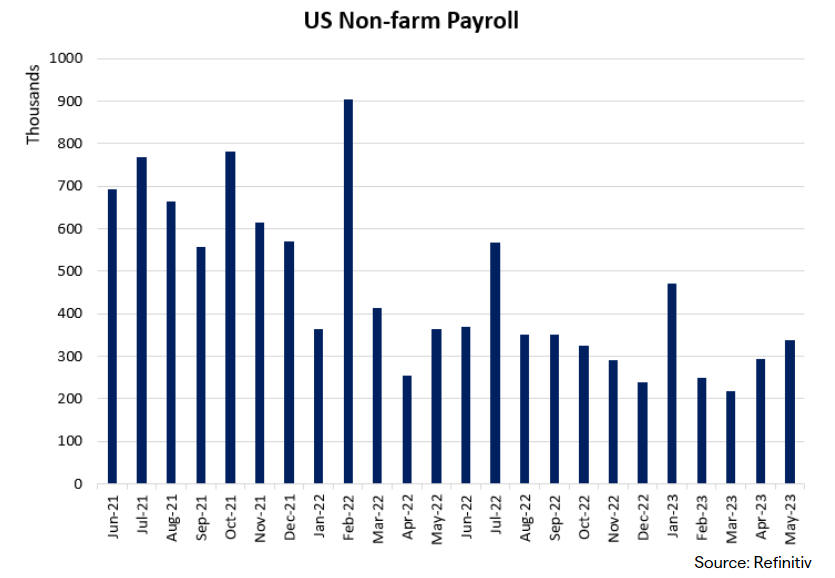

Over the past twelve months, the U.S. job report has outperformed market expectations on 11 out of 12 occasions, and another set of better-than-expected readings may reinforce hopes of a soft landing (a possibility that the U.S. economy escaped a deep recession). The U.S. economy added 339,000 jobs in May 2023, and in the chart below, we can also see how the job market performed since June 2021.

While sentiment-based indicators show that investors are no longer in panic, a recommendation is that you should continue to take a defensive investment approach in the upcoming days because another strong job report could also pressure the Fed to do more by anchoring a 25 bp hike this month and pushing back against the timeline for rate cuts. The next Federal Reserve meeting is on July 26. The CME Group survey shows a high probability of a 25 basis point rate increase.