September is historically the worst month for the S&P 500 on average, going back nearly a century, and the main question is, will history repeat? The September Effect is a supposed market anomaly whereby stock market returns are relatively weak, and it is generally believed that investors return from summer vacation in September ready to lock in gains as well as tax losses before the end of the year.

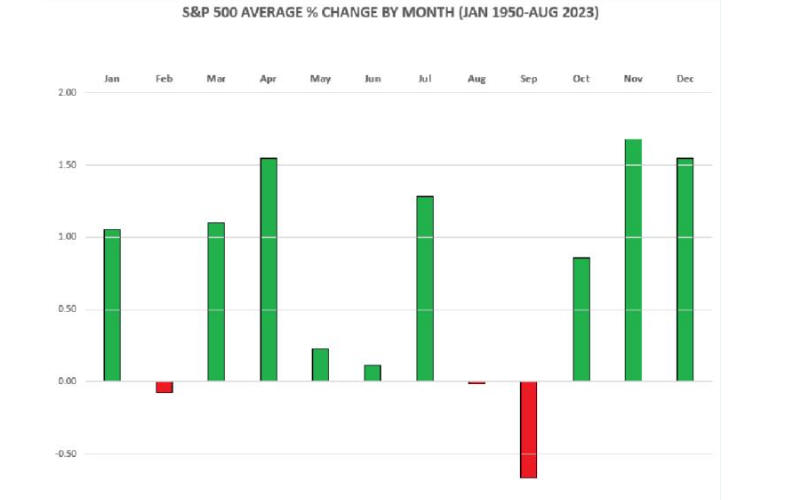

There is also a belief that individual investors liquidate stocks going into September to offset schooling costs for children, while another theory says that since investors expect the September Effect to happen, market psychology takes hold, and sentiment turns negative to align with those expectations. The S&P 500 has suffered an average decline of 0.7% during September, finishing positive just ~44% of the time, and in the graphic below that uses LSEG data, we can see the S&P 500’s average percent change by month since 1950.

Stocks aren’t the only assets that can lose their value if history repeats and scares investors to stay away from risks. Government bonds and real estate prices could also fall, and cryptocurrencies will not certainly be in the situation to escape a fall. The crypto market displayed a high correlation with U.S. equities, and if a downtrend is witnessed in the stock market, the same is usually replicated in the crypto-sphere as well.

The most significant market crashes, such as the Great Depression in 1929 and the 2008 financial crisis, occurred in September or October, but while historical patterns can offer insights, they are not definitive predictors of future market movements. While it is true that September has been the worst-performing and most frequently negative month over the past century, investors should base their decisions on a wide range of factors, including economic conditions, corporate earnings, and geopolitical events.

The positive news is that analysts from Goldman Sachs lowered their estimated 12-month recession probability to 15% this week, down five percentage points from its prior forecast. Analysts from Goldman Sachs said:

“Last week, government data showed that the world’s largest economy added more jobs than expected in August, though the unemployment rate unexpectedly rose, and we still strongly disagree with the notion that a growing drag from the long and variable lags’ of monetary policy will push the economy toward recession. We are “substantially more optimistic” than most other forecasters in terms of baseline economic growth outlook, which averages 2% through the end of the next year. “