Investor optimism fell after the U.S. job report that was released this Tuesday showed that the U.S. job openings unexpectedly rose in August amid a surge in demand for workers in the professional and business services sector.

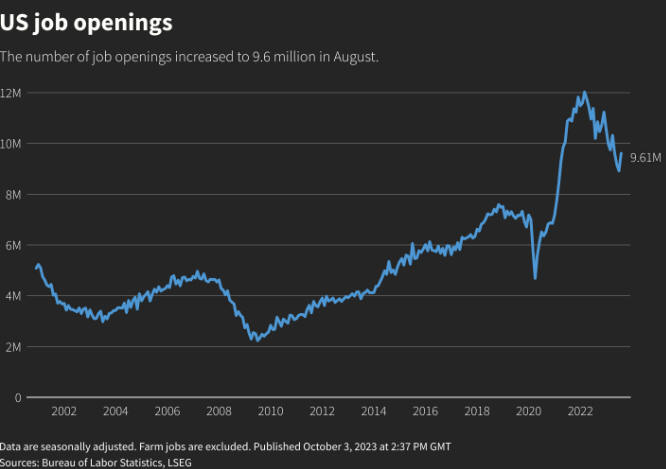

The Bureau of Labor Statistics reported that U.S. job openings, a measure of labor demand, jumped 690,000 to 9.610 million on the last day of August, pointing to tight labor market conditions that could compel the Federal Reserve to raise interest rates next month. Economists polled by Reuters had forecast 8.800 million job openings in August, and it is important to mention that this increase in U.S. job openings was the most in just over two years.

Strong U.S. job openings data indicate that we could see one more rate hike this year, while Fed Atlanta President Raphael Bostic already said it would likely be a long time until rate cuts arrive. Fed Chair Jerome Powell also said that the rate-hiking cycle will probably last longer than many on Wall Street want, while Cleveland Fed leader Loretta Mester said that she sees the potential for another rate hike in November if the current state of the economy holds.

Wall Street’s three main indexes dropped immediately after the news, and worries over interest rates staying higher for longer continue to keep the 10-year Treasury yield buoyant. Jason Pride, chief of investment strategy and research at Glenmede in Philadelphia, said:

“We do have potentially one more Fed rate hike coming at the tail end of this year. Any strength in the jobs market can push us in that direction and strengthen CPI.”

The focus of investors now shifts to the non-farm payrolls report that will be released this Friday for further clues on the state of the U.S. labor market. Financial markets dialed down expectations that the U.S. central bank would keep rates unchanged at its Oct. 31-Nov. meeting and Friday’s payroll data should help clarify if the labor market is as strong as the JOLTS report implies.

A stronger-than-expected report on Friday will be the last thing the Fed wants to see, not to mention financial markets, and a recommendation is that investors should continue to take a defensive investment approach. There are expectations of “market turbulence” from macro uncertainty, and the upside potential for stocks and cryptocurrencies probably remains limited for the weeks ahead.