U.S. stocks continue to show positive development at the beginning of this trading week as investors wait for guidance from Federal Reserve policymakers on the central bank’s policy path. Last week, U.S. stocks recorded their most significant weekly percentage increase in approximately a year. This surge was triggered by a U.S. job report that fell short of expectations on Friday, leading to a decline in Treasury yields. This decline in treasury yields was influenced by the assumption that the Federal Reserve might have completed its interest rate hikes and could potentially initiate rate cuts in the upcoming year.

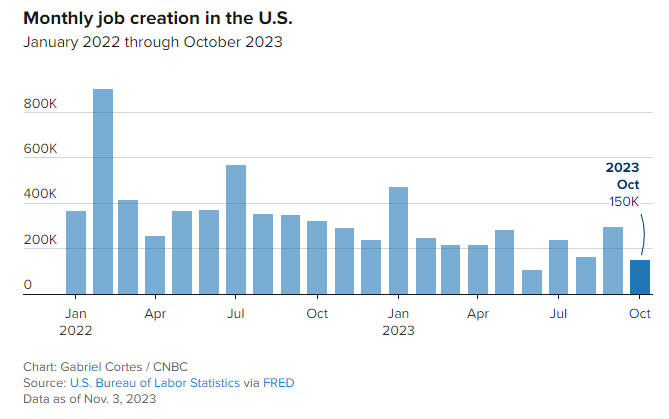

The U.S. economy saw job creation decelerate in October. The Labor Department reported on Friday that the country opened 150,000 new jobs for the month, against the Dow Jones consensus forecast for a rise of 170,000. The primary cause of the gap was the United Auto Workers strikes, which resulted in a net loss of jobs in the manufacturing industry. At the same time, the unemployment rate climbed to 3.9%, reaching its highest point since January 2022, against expectations that it would hold steady at 3.8%. Becky Frankiewicz, chief commercial officer at staffing firm ManpowerGroup, said:

“After years of incredible strength, the labor market could finally be slowing. The post-pandemic hiring frenzy and summer hiring warmth have cooled, and companies are now holding onto employees.”

A broader unemployment rate, which considers discouraged workers and individuals working part-time due to economic reasons, increased to 7.2%, marking a 0.2 percentage point rise. The labor force participation rate decreased slightly to 62.7%, and the labor force shrank by 201,000 individuals. Following Friday’s jobs data, markets further reduced the probability of a rate hike in December. According to many analysts, further tightening is now highly unlikely, and rate cuts could be back on the table next year.

Market expectations that the Federal Reserve will keep interest rates unchanged at its December meeting currently stand at 90.4%. This figure has slightly decreased from 95.2% on Friday but remains notably higher than the 74.4% probability recorded a week ago. Furthermore, expectations of a rate reduction of at least 25 basis points at the May 2024 meeting have increased to over 50%, as CME’s FedWatch Tool reported. Investors will seek a better understanding of the Federal Reserve’s plans through statements from critical officials later in the week, which may include insights from Chair Jerome Powell and voting members like New York Fed chief John Williams and Dallas Fed President Lorie Logan.