Key Findings: BTC Technical Analysis

- In anticipation of the upcoming bull cycle, the price of bitcoin may return to its peak in 2024, which was over $69,000.

- Bitcoin might drop by 5% to test the psychological level of $40,000. Alternatively, it might drop by 10% to the crucial support level of $37,800.

- The bearish argument would be refuted, and the tone would be set for continuation if the market broke and closed above $45,000.

BTC Technical Analysis – BTC Daily Price Chart

In 2023, the price of Bitcoin (BTC) has been rising, attempting to regain the ground lost in the wake of the crashes of FTX and Terra (UST) the year before. Despite being a tumultuous year, the trajectory gained shape, with Bitcoin riding the tide of advances in the sector and macroeconomics.

Since the beginning of December, the price of Bitcoin has been trapped inside the weekly supply zone, which is an order block that spans from $42,000 to $45,000.

Interestingly, the most significant Fibonacci level, 61.8%, at $43,821, corresponds with the midpoint of this order block. The level must beat for an affirmation of the uptrend. The upswing would be confirmed if this level were broken and closed above.

The next directional bias will be revealed by a clear move below $37,800 or above the psychological level of $48,000.

See Related: Bitcoin And Ethereum Technical Analysis

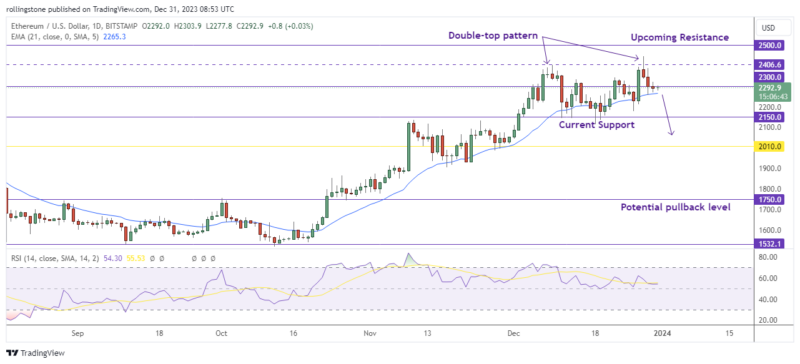

Key Findings: ETH Technical Analysis

- Ethereum price got rejected above $2,400, plotting a double top pattern in the daily chart.

- While writing this report, ETH/USD tested the support at $2,300.

- We may see Ethereum rally back to the support near $2k once again if the price breaks the 21 EMA support at $2,265.

Ethereum Technical Analysis – ETH Daily Price Chart

Ethereum is trading at $2,433, which recently broke through a critical $2,334 resistance level. The inverse head & shoulder formation, a well-known bullish pattern in the past, depends on this price point.

However, the ETH price rejected a move above the $2,400 level for the second time, plotting a double-top pattern. A break of the current 21 EMA support at $2,265 might lead the price to initiate a bearish momentum and rally toward the $2,010 level.

For a bullish outlook, Ethereum exceeding the $2.4K level might increase by an additional 5% before hitting the target price, allowing the altcoin to surge to $3,000.