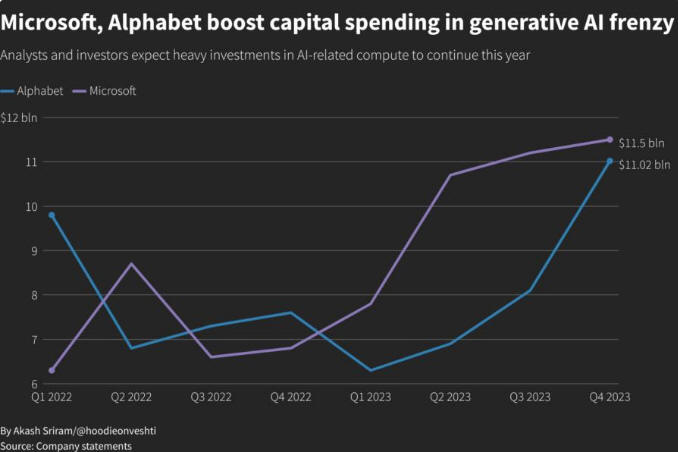

Wall Street’s main indexes fell as Alphabet’s projections for rising AI costs dented most megacap and chip stocks while the Federal Reserve left interest rates unchanged this Wednesday. Google’s parent company experienced a 6.1% decline, resulting in a 3.0% drop in the S&P 500 communication services sector. This occurred following its announcement of holiday-season advertising sales falling short of expectations and its projection of increased spending on artificial intelligence.

Microsoft (Nasdaq: MSFT) also lost 1.3% after forecasting higher costs to develop new artificial intelligence features, which overshadowed its upbeat quarterly results. Despite the optimistic outlook from the tech pioneers regarding customer enthusiasm for their generative AI-powered products, investors grew concerned about escalating development expenses for these innovative features. These mounting costs tempered their hopes for a significant sales surge from the new technology.

These results and forecasts from big tech names, along with Tesla’s growth warning last week, have reignited attention on the risks associated with the significant influence of mega-cap companies in the S&P 500 which has hit record highs in recent weeks. Apple, Meta Platforms, and Amazon.com set to report earnings on Thursday, fell over 1% each.

See Related: New Bitcoin Core Update May Natively Support Apple M1 Chips

Revenue Forecast And Increased Projection

It is also important to mention that Advanced Micro Devices saw a 3.3% decline as its first-quarter revenue forecast and increased projection for AI processors fell short of expectations. Other chip stocks including Nvidia, Broadcom, and Marvell dropped over 1% each. The attention of investors was also on the Federal Reserve’s initial monetary policy decision of the year, and while it was widely anticipated that the Fed would maintain interest rates, many analysts said that the Fed is taking baby steps toward the cutting. Art Hogan, Chief Market Strategist of B.Riley Wealth, said:

“Not surprisingly, I don’t think the Fed wants to show their hand, especially, when they have a couple of months of data to collect before they need to. The good news is we can forget about any more tightening. The bad news is it’s ‘when’, not ‘if’, they’re going to cut rates, and that ‘when’ has been pushed out to what had been the fringes of consensus.”

Due to this, markets are showing some immediate disappointment as there’s no explicit indication of imminent rate cuts. We’re seeing an extremely neutral, non-committal statement from the Federal Reserve this Wednesday.