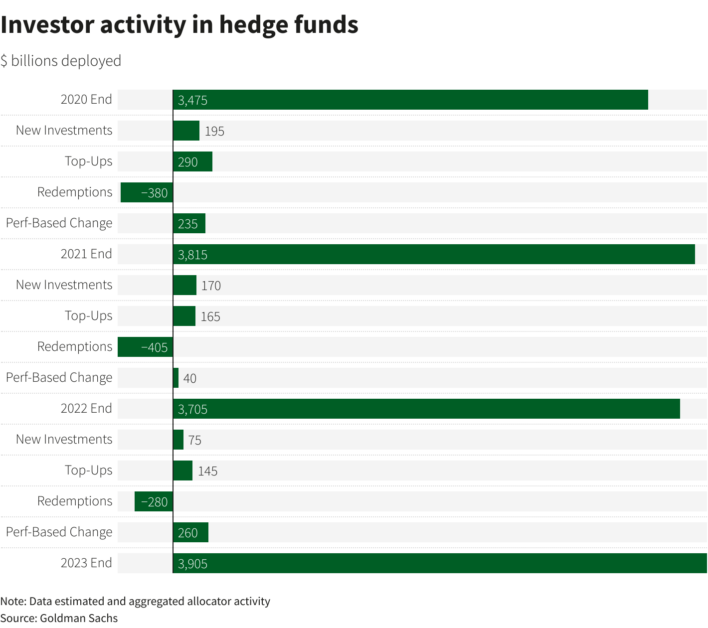

2023 painted a picture of contrasting fortunes in the realm of hedge funds, as revealed by a recent report from Goldman Sachs, narrated by Reuters. While established players in the industry experienced soaring fees and continued success, new entrants faced significant challenges in launching and gaining traction.

According to the report, investments in new hedge funds plummeted to unprecedented lows in 2023. Meanwhile, established hedge funds seized the opportunity to hike fees to record highs, reflecting a growing preference among investors for seasoned and larger players in the market. Goldman Sachs highlighted that these established funds tend to deliver higher average returns to their investors, adding weight to their appeal.

The geographical breakdown further illuminates this trend, with hedge fund launches declining in Europe and the Asia Pacific region by 6% and 8%, respectively, while witnessing a 14% increase in the U.S. Nevertheless, Goldman Sachs underscored that 2023 marked a second consecutive year of record-low new launches across the hedge fund landscape.

See Related: Goldman Sachs’ Leap Into AI: Unveils Dozen Generative Artificial Intelligence Projects

Despite the decline in new launches, management fees reached their highest levels since 2012, indicating that investors were less focused on fee reduction and more inclined towards negotiating better terms with hedge funds. The report, based on 358 interviews conducted in December 2023, representing over $1 trillion in hedge fund assets, suggested various strategies, including fee reductions as assets under management (AUM) rise and the implementation of performance-based fee structures.

Investors Dissatisfaction With Hedge Fund Performance

Interestingly, a significant portion of investors expressed dissatisfaction with hedge fund performance in 2023, as the industry underperformed traditional stock and bond portfolios by 9%, marking the worst result in nearly three decades. However, there remains optimism for improvement in the coming year, with investors expecting better results from hedge funds in 2024.

Yet, questions linger regarding the value proposition of hedge funds, particularly for investors dissatisfied with performance. As one allocator anonymously quoted in the report queried, if hedge funds fail to deliver positive results, are the fees, complex investments, and locked-away capital justified?

Looking ahead, investor sentiment towards hedge funds appears mixed, with 15% of allocators planning to decrease their hedge fund holdings by the end of 2023, while 31% expressed intentions to increase exposure. Notably, despite optimistic projections in 2022, only 28% of allocators increased their hedge fund allocations throughout 2023, compared to 42% who initially intended to do so.

This landscape certainly presents a nuanced picture of challenges and opportunities, with established players capitalizing on market dynamics while new entrants navigate a formidable landscape. The trajectory of the industry in 2024 remains uncertain, with investors seeking improved performance and greater transparency from hedge funds to justify their continued investment.