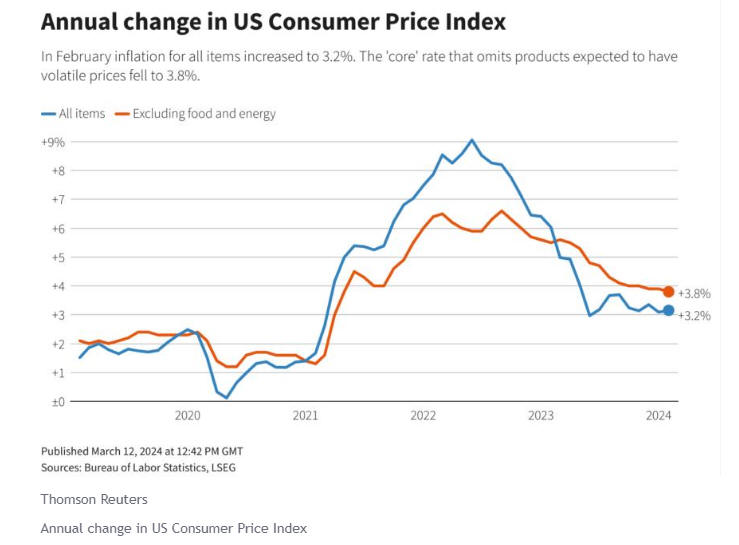

U.S. stocks ended sharply higher on Tuesday after the Labor Department reported that the Consumer Price Index (CPI) rose 0.4% last month after climbing 0.3% in January. Year-on-year, headline and core CPI came in at 3.2% and 3.8%, respectively and it is important to say that both readings were only 10 basis points hotter than some analysts expected.

Looking at individual categories, energy prices surged by 2.3%, gasoline jumped by 3.8%, and airfares increased by 3.6%, catching attention. However, there are positive notes as services and shelter, previously seen as barriers to a sustained cool-down, decreased to 0.5% and 0.4%, respectively.

Although we observe a continuing downward trend in inflation, the gradual advancement witnessed over recent months is expected to prompt the Fed to seek further assurance that inflation is steadily returning to its 2% target.

Expectations in the market regarding the timing of the Fed’s initial rate cut mostly stayed the same and the CME’s FedWatch Tool reported that there is a 66.2% probability of a cut of at least 25 basis points in June, a slight decrease from 71.7% in the previous session.

Oliver Pursche, senior vice president and advisor for Wealthspire Advisors in Westport, Connecticut said that the US economy continues to be healthy and from his perspective as a consumer, employee, and investor, he would rather have a strong economy and slightly elevated interest rates than a weak economy that requires stimulus.

See Related: Wall Street’s Main Indexes Tumbled As Hot Inflation Data Dampened Early Rate-Cut Hopes

S&P 500 Advanced To Record High

The S&P 500 advanced to a record high supported by the optimism and ended at 5,175.06 points, the Nasdaq Composite gained 1.53% at 16,264.08, while the Dow Jones Industrial Average rose 230.43 points, or 0.59%, to 39,000.09. Bill Dunkelberg, NFIB’s chief economist, said:

“While inflation pressures have eased since peaking in 2021, small business owners are still managing the elevated costs of higher prices and interest rates, The labor market has also eased slightly as small business owners are having an easier time attracting and retaining employees.”

However, some economic analysts said that the central bank became too focused on inputs after misreading inflation in 2021 and they warned that the Fed risk a recession if it cut rates later than June. Simultaneously, the increase in geopolitical uncertainties presents an extra hurdle and amplifies the possibility of unexpected risks in both markets and economic outcomes and the recommendation for investors is to take a defensive approach in the months ahead.