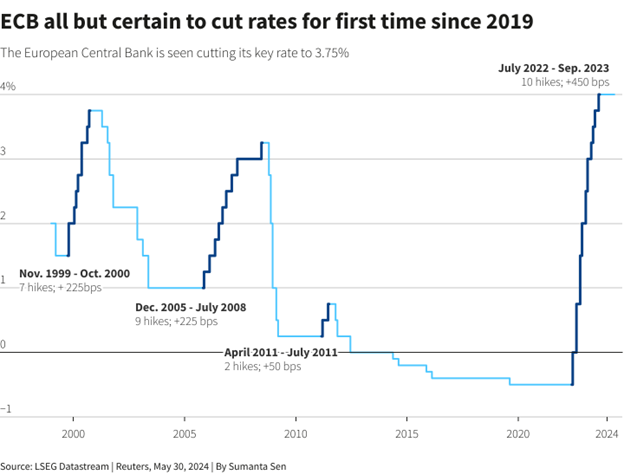

As reported by Reuters, the European Central Bank (ECB) is poised to cut interest rates for the first time since 2019 this Thursday. However, the central bank’s subsequent moves remain a puzzle, raising several critical questions that financial markets grapple with.

- Will the ECB Finally Cut Interest Rates This Week? Most likely, as numerous policymakers have all but promised a June rate cut. The expectation is a 25 basis-point reduction, bringing the ECB’s deposit rate down to 3.75% from the record 4% reached last September.

- What Will the Rates Path Look Like After June? This is much less certain. Markets now expect fewer than 60 basis points of cuts this year, implying two moves and less than a 50% chance of a third, down from three when the ECB last met in April and at least five in January.

See Related: President Of European Central Bank Believes Crypto Is ‘Worth Nothing’

While many forecasters still anticipate three cuts – in June, September, and December – hawks are trying to take a July move off the table. ECB chief Christine Lagarde is expected to reiterate the bank’s “data dependent” mantra, providing little guidance on future moves.

- How Big of a Headache is Accelerating Wage Growth for the ECB? Not a huge one, according to economists. Although wage growth rose to 4.69% in the first quarter, the ECB seems unconcerned, publishing a blog emphasizing that other wage indicators point to moderating pressures.

However, services inflation rebounded in May, and record-low unemployment may cast uncertainty on how much wages will cool, potentially influencing the pace of rate cuts.

- What About a Strengthening Euro Zone Economy? Surprisingly, this is not a cause for concern. The bloc’s economy grew 0.3% during the first quarter, beating expectations. Economists reckon the numbers are good news for the ECB, as the uptick in activity could boost productivity growth, aiding in slowing inflation without reigniting demand-driven price pressures.

- What Will the ECB’s New Projections Show? The bank is expected to revise its growth and inflation projections slightly upward, but the big picture should remain the same as in March – inflation returning to the 2% target in late 2025.

As the ECB navigates these questions, its messaging and actions will be closely watched by financial markets and economic analysts alike. The road ahead for monetary policy remains uncertain, with the central bank treading cautiously to balance economic growth, inflation, and wage pressures.

Outlook Of ECB’s Rate Cut

The ECB’s upcoming rate cut is a widely anticipated move, but the central bank’s future actions remain uncertain. While a 25 basis-point reduction is likely this week, the pace and magnitude of subsequent cuts will depend on a delicate balancing act between economic indicators, inflation dynamics, and wage growth.

As the euro-zone economy shows signs of resilience and services inflation remains sticky, the ECB may adopt a more gradual approach to rate cuts, waiting for clearer signals of moderating wage pressures and sustained disinflation. However, if economic conditions deteriorate or inflation proves more stubborn, the central bank may be forced to accelerate its rate-cutting cycle.

Moreover, the ECB’s messaging and forward guidance will be crucial in shaping market expectations and influencing financial conditions. As hinted by Lagarde, a cautious and data-dependent approach may leave room for policy flexibility, but could also contribute to market volatility and uncertainty.

Ultimately, the ECB’s ability to navigate these challenges and strike the right balance between supporting economic growth and anchoring inflation expectations will be critical for the euro zone’s economic stability and the credibility of its monetary policy framework.