Interest in digital asset exchange-traded funds (ETFs) continues to rise, with nearly half of the investors surveyed in a recent report expressing plans to invest in U.S.-based crypto ETFs.

The report, published by Charles Schwab, reveals that millennials and older generations are showing increased interest in these financial products, reflecting a broadening appeal across age groups.

According to the findings, 45% of respondents plan to invest in digital assets via ETFs in the coming year, a notable increase from 38% the previous year. The report further highlights that ETF investors have become more optimistic about multiple sectors, with a growing number viewing cryptocurrencies as a viable investment opportunity.

See Related: What’s Behind The $530M CryptoPunk #9998

The Bitcoin ETF Era

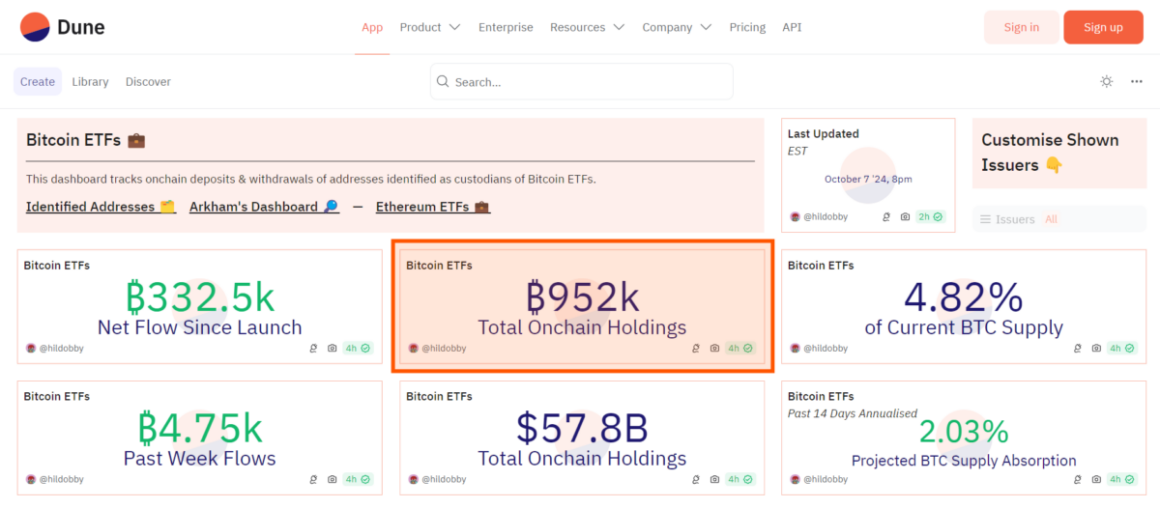

ETFs are widely used investment tools that allow investors to purchase shares linked to assets like gold and Bitcoin. The U.S. approved Bitcoin spot ETFs in January now hold 951,900 Bitcoin, representing 4.82% of the total Bitcoin supply.

This influx has been largely driven by institutional investors, with many major players buying shares in these ETFs. In the Q3 report, the number of institutions engaged in Bitcoin ETFs rose significantly, reflecting growing confidence in the asset. Companies like MicroStrategy, Semler Scientific and Metaplanet have also embraced Bitcoin, incorporating it into their long-term investment strategies.