What Is NFT Wash Trading?

Wash trading in regards to NFTs is the process of buying and selling NFTs in a way to manipulate or mislead the market through artificially increased prices or heightened trading volume.

After the success of projects like CryptoPunks and B.A.Y.C., users are keen to find the next big thing. Wash trading creates a false sense of urgency and demand for a certain project making it seem ‘on the rise’. FOMO is a dangerous emotion to play in the markets, but investors will often overlook the small details.

The process usually occurs when one user buys their own NFT on a separate wallet. In turn, this gives their NFT an artificially raised price from what it was.

How To Identify Wash Trading In NFT Projects

The most important thing is to always do your own research prior to any purchase, not just for NFTs.

Using a site like Etherscan allows you to look at the history of the token, sites like Opensea also have this feature within their platform. If you happen to see the same wallet within multiple transactions on the NFTs history, it is most likely a sign of wash trading.

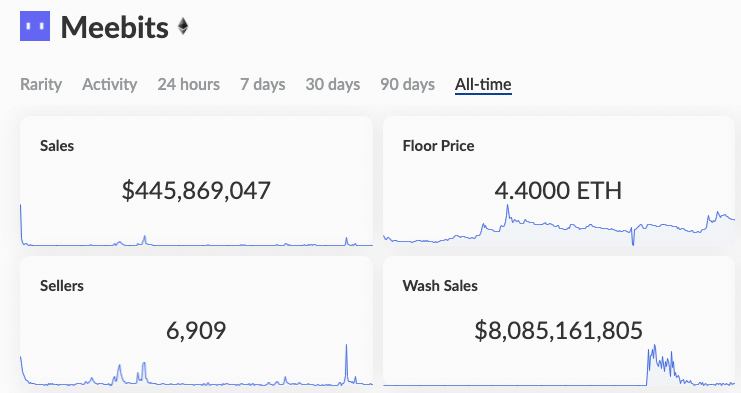

NFT analytics site, CryptoSlam! allows users to search for certain NFT projects. Under each project, there is a section showing the amount of money classified under wash sales in the project.

Examples Of NFT Wash Trades

There have been a lot of users who have come across this type of market manipulation, here are some examples.

- CryptoPunk #9998 which sold for $530 million using a flash loan.

- Meebit #13824 selling for over $49.5 million

- A Coinbase employee was arrested over allegations including wash sales. [1]https://www.cftc.gov/PressRoom/PressReleases/8369-21

- 95% of the trading platform LooksRare’s volume is derived from wash trading

References