What Are Tokenized Assets?

Tokenized assets allow for information and value to be stored, transferred, and verified on a blockchain using distributed ledger technology. Both physical and digital assets may be turned into fungible tokens.

Tokenized assets that are native to a blockchain or any digital system can easily be fractionalized, allowing for greater and fairer distribution compared to traditional and very illiquid assets. Using blockchain technology also allows for faster settlement with certain results showing up to a 90% reduction in the cost of bond issuance when using blockchain ledger technologies compared to traditional financial instruments.[1]HSBC – Gateway For Sustainability Linked Bonds

On the other hand, the tokenization of assets may also be non-fungible, meaning that they cannot be broken up into smaller pieces. However, even these types of assets can be sold fractionally on certain decentralized applications.

According to a 2022 survey from Celent, over 91% of institutional investors have signalled interest in investing in tokenized digital assets.[2]Celent – Migration To Digital Assets Accelerates, Page 1

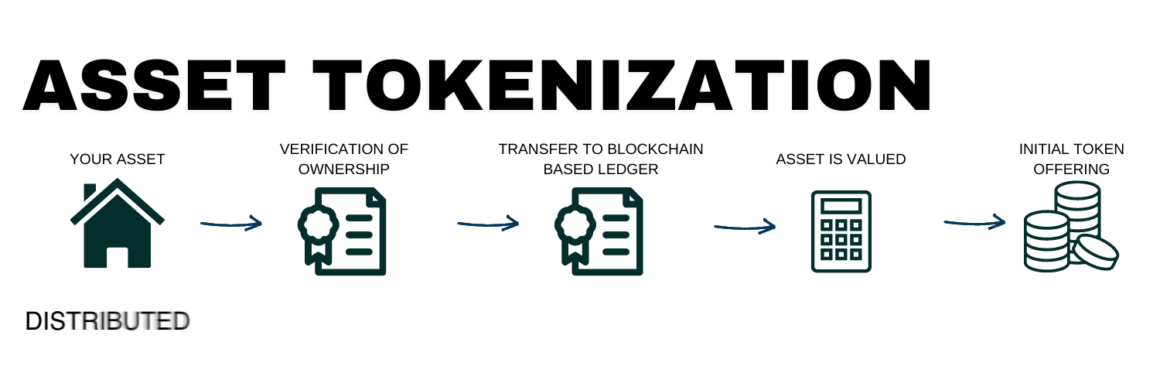

How Do Tokenized Assets Work?

Tokens are typically created and stored within a smart contract living on a blockchain. Traditional assets that aren’t secured by blockchain technology differ to digital tokens because of the benefits that smart contracts provide, including immutability, verifiable and self-executing agreements, open-source software, and their lack of a centralized entity.

Real-world assets such as a piece of prime real estate in the middle of a city are valued at $10M. Typically this type of building would only be available for the top investors with the best credit scores. Through tokenization of the building, fractional ownership of the $10M valuation could be split between 10,000 or 100,000 tokens worth $1000 or $100.

These real estate tokens would be available to institutional and retail investors worldwide. Being sold on secondary markets, there may be more of an inclusion for the ownership of assets. The smart contract securing the token would ensure, depending on your holdings, that you receive the correct percentage of income made on the building.

Token Classes: What Can Tokenized Assets Be Used For?

Coins

A digital coin is used and designed in the same way as government-issued fiat, as a means of payment. Although, one key difference in its design is that coins are digitally native and separate from central banks. Coins represent cash, tokens everything else.

Security Tokens

A security token expresses traditional security or intangible asset such as equity, debt, or a combination of both as a digital representation. Due to their digital nature security tokens can be programmed to incorporate unique characteristics and ownership rights.[3]Gemini Cryptopedia – What Is Tokenization in Blockchain?

Tokenized Securities

Tokenized securities are not the same as security tokens.[4]Gemini Cryptopedia – What Is Tokenization in Blockchain? Tokenized securities broaden the liquidity and accessibility of security by tokenizing it. They do not incorporate unique characteristics, and ownership rights like security tokens do.

Utility Tokens

Utility tokens offer access to specific services and products. Utility tokens are not created with investors at the forefront.

A common analogy used is Uber. If Uber were to create an “Uber Token” it could be used to pay for rides on the network and nothing else.

Utility tokens are usually used to vote in consensus mechanisms, pay transaction fees, receive airdrops, or share data between peers and are typically released through an initial coin offering (ICO).

References