Mike McGlone is a senior strategist at Bloomberg Intelligence, has recently shared multiple on Twitter discussing various commodities and concerns related to the current state of markets worldwide.

- In one tweet McGlone outlined his September Crypto Outlook where he believes that the world is leaning towards a recession in light of recent events including the tightening of interest rates by the Federal Reserve.

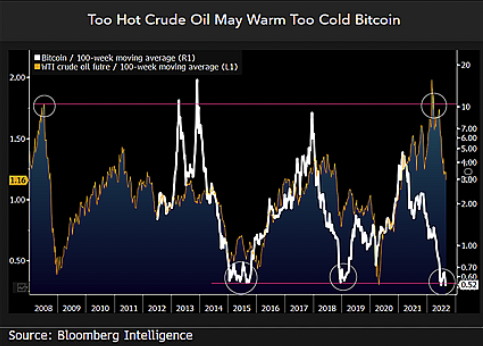

- A key indicator that had encouraged the Fed’s fight against inflation was the soar in energy prices. This pressured high-risk assets, namely cryptocurrencies, and once the dust settles from recent events crypto prices will start to “bouy” as “crude oil decline may fuel Bitcoin recovery.” Reuters recently reported that the Strategic Petroleum Reserve (SPR) fell to its lowest level in more than 35 years.

- Price data from 2018-19 was compared to price data from today showing a similar benchmark where “Bitcoin is at a discount within an elongated bull market.”

- In an interview with Bell Media, McGlone believes that cryptocurrencies will continue to outperform traditional assets with declining volatility. He hints at being bullish on Bitcoin believing will put in a bottom at, or below $20,000 similar to 2018 and 2013 before going into an upward trajectory.

- McGlone hinted at Ethereum becoming a large part of the financial system as the merge approaches due to its ability to make tokenized assets readily accessible to the public just like ETFs had done with traditional assets.

See Related: Bitcoin Will Return – Ruchir Sharma, The Chairman Of Rockefeller International