Jocelyn Yang, a New York-based cryptocurrency reporter for CoinDesk, posted her in-depth analysis on the recent Solana price crash following the Alameda exposure and FTX Bankruptcy. In her report, she explained why SOL, alongside other altcoins, may gradually keep losing investor confidence in the long run.

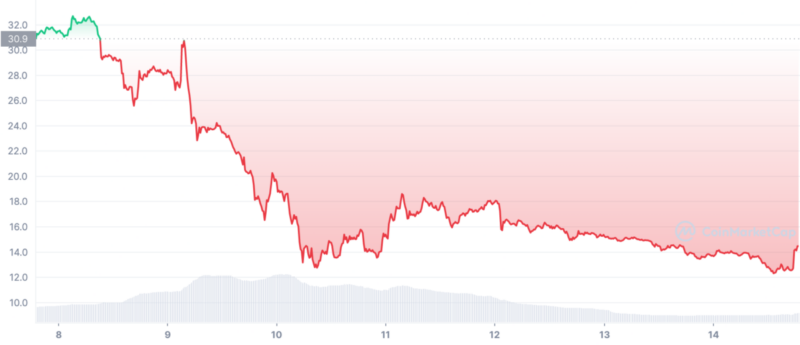

- The SOL token on the Solana blockchain suffered one of the worst crashes following a sharp sell-off in cryptocurrency markets brought on by the quick demise of Sam Bankman-Fried’s empire. The price dropped even more on Friday after the former billionaire’s primary holding company sought bankruptcy protection.

- SOL’s price fell to a record low of about $12 earlier this week before rising 26% to a high of $19 on Thursday. According to the argument, Alameda might need to sell its SOL tokens to increase liquidity. SOL increased on Thursday due to Solana Foundation delaying its plan to “unstake” 28.5m SOL tokens, signaling an end to increased selling pressure right away.

- However, on Friday, on the news of FTX’s bankruptcy, the price had dropped back to roughly $16, losing 6.4% in a single day. The SOL price has decreased by 50% in the last seven days.

- The increased volatility has generated a discussion about Solana’s long-term prospects among cryptocurrency analysts, blockchain developers, and executives. There are lingering concerns about the blockchain’s prospects and how much the industry’s repercussions from this week may influence it.

See Related: Ethereum (ETH) Price Prediction After FTX Filed Chapter 11 for Bankruptcy