After FTX’s demise, investors are getting out of centralized exchanges and welcoming decentralized finance platforms.

- Investors started pulling out their cryptocurrencies off of centralized exchanges after FTX’s scandal hit front page. It becomes a bother leaving your assets in the hands of a centralized entity. Holders are leaning toward self-custody practices while traders are engaging and willing to learn how to navigate the defi (decentralized finance) space.

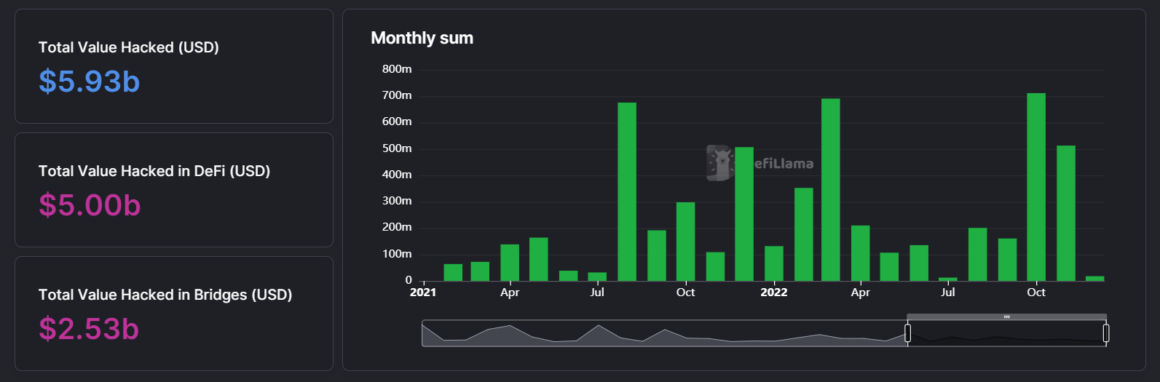

- As centralized exchanges are vulnerable to risks like bankruptcy, the defi platforms are a feeding ground for hackers. According to the data of DefiLlama, the largest multi-chain defi TVL (total value locked) aggregator, defi-related hacks account for $3.24 billion in 2022 alone. Overall, there is $5.00 billion worth of hacked defi funds wherein the $2.53 billion was due to bridge exploits.

- Despite growing concerns on whether it is safe engaging with defi platforms, defi-related hacks this month is significantly low. It is notable that in December this year, the total value exploited was $17.71 million as of writing. Which is only 2.5% of the total amount hacked during October 2022. It is not clear yet what caused the decline but it shows us that defi platforms are learning from the mistake of unfortunate others.

- Regardless of hack risk, crypto projects would rather get hacked than pay bounties. In a tweet by a Web3 developer, he claimed that he found a vulnerability in a Solana smart contract. According to the dev, he reported and helped fix the problem. But when he requested a reward, the project started ignoring him.