Transitioning from Proof-of-Work (PoW) to Proof-of-Stake (PoS), Ethereum is aiming to be a deflationary asset. Here’s an overview of 2022 and what to expect in the years to come.

- Ethereum’s most awaited improvement proposal (EIP 3675) was executed last September 15, 2022. This brings the second largest cryptocurrency to become environmentally friendly. EIP 3675 or “The Merge” as we popularly know it will stop using mining rigs the way bitcoin does. Which will lead to a reduction of energy consumption of up to 99.95% and lower carbon emissions.

See Related: The Misconceptions With The Ethereum Merge

- By removing the usage of mining machines, Ethereum’s issuance drops from 15K ETH/day to 1.5K ETH/day. The EIP 1559 is another improvement proposal that focuses on the destruction of ETH which aims to lessen the supply circulating in the market. With these two working hand in hand, Ethereum can become ultra-sound money.

- Sound money is any form of money that has its purchasing power determined by the market. A good example of this is gold and bitcoin for they will have a scarce supply. An ‘Ultra Sound Money’ is a meme that refers to ETH’s decrease in supply. While sound money has limited supply, ETH’s ‘ultra-sound money’ aims to deflate its supply.

Ethereum Burn Rate

- As of writing the circulating supply of ETH is 120,525K which is significantly close to the ETH circulating supply post-merge of 120,521K. In 108 days since ‘The Merge’, there are only 4,837.78 new ETH to the circulating supply. In comparison to using mining machines, which will bring 1,458K new coins into the market.

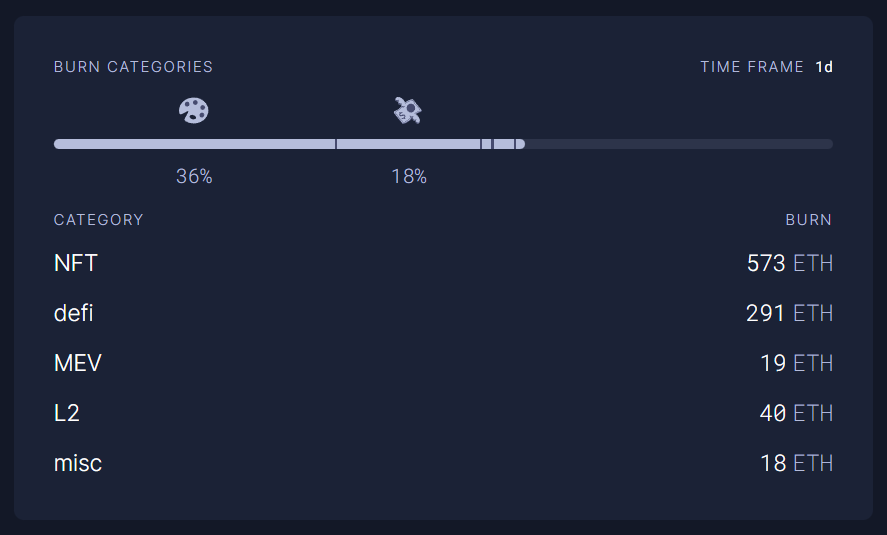

- The burning of Ethereum coins is at an average of 1,580 ETH/day. NFT marketplaces (36%) and DeFi platforms (18%) largely contribute to the burning of ETH.

- Ten years from now, the supply of ETH in the market is projected at 108.3 million which is 11% lower than today. And in 2223, 200 years from now, the supply of ETH is expected to reach equilibrium at a supply of 52.1 million coins.