- The bank run was fueled by several factors, including scandals and compliance failures, social media speculation, and the failure of other banks.

- The bank run has had a significant impact on Credit Suisse, which reported a loss of US$1.5 billion in the first quarter.

- Credit Suisse experienced an acute case of bank run in Q1 2023, when customers withdrew US$75 billion in a matter of weeks.

What Is A “Bank Run”?

A bank run is a situation in which many people withdraw their money from a bank at the same time. This can happen when people lose confidence in the bank’s ability to repay their deposits. As more people withdraw their money, the bank’s reserves are depleted, and it may eventually be forced to close its doors. Reasons for loss of confidence may include involvement in scandals or economic downturns.

What Caused The Bank Run At Credit Suisse?

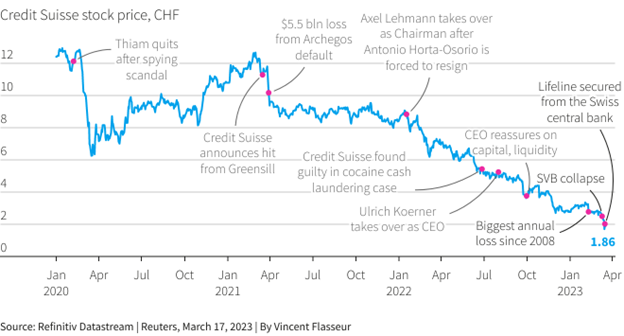

Several factors contributed to the bank run at Credit Suisse (see chart below), these include:

- Scandals and compliance failures: In recent years, Credit Suisse has faced numerous scandals and compliance failures that have damaged its reputation. In 2019, the bank was fined $4.5 billion by the U.S. Department of Justice for its involvement in a corruption scandal, and in 2022, it was fined $2.2 billion by the U.S. Securities and Exchange Commission for its involvement in the collapse of Greensill Capital. As a result, public trust in the bank diminished.

- Social media speculation: Late last year, a journalist’s tweet created speculation that a significant investment bank was close to failure, resulting in investors assuming that the bank mentioned was Credit Suisse. This led to deposits in billions being wiped out and the bank’s stock price decreased.

- Failure of other banks: In late 2022, two other major banks, Silicon Valley Bank and Signature Bank, defaulted. The failure of these banks further eroded confidence in the banking system and led to a wave withdrawal.

See Related: HSBC’s UK Branch Acquires Silicon Valley Bank’s UK Branch For A £1

The Impact Of The Bank Run On Credit Suisse

The bank run has had a significant impact on Credit Suisse. In the first quarter of 2023, the bank reported a loss of US$1.5 billion. The bank has also been forced to sell assets and raise capital to shore up its balance sheet. The bank run has also damaged the reputation of Credit Suisse and could make it more difficult to attract new customers and investors in the future.

See Related: BlackRock Contracted To Dispose Of Credit Suisse Asset-Backed Bonds

Key Takeaways On Bank Runs

The bank run at Credit Suisse is a reminder of the risks that banks face.

- When public confidence in a bank is shaken, it can lead to a rapid withdrawal of deposits, which can ultimately force the bank to default.

- Bank runs can be contagious. When one bank fails, it can lead to a loss of confidence in other banks, which can then lead to more bank runs. This is why it is important for regulators to take steps to prevent bank failures.

- Bank runs can have a negative impact on the economy. When banks fail, it can lead to a loss of deposits, which can make it difficult for businesses to get loans. This can lead to a decline in economic activity.