The largest exchange in the world in terms of trading volume, Binance, announced on Monday, that it will merge stablecoin competitors USDC, USDP, and TUSDs order books and auto-convert them to Binance USD-backed stablecoin, $BUSD.

- The conversion will take place on September 29th in which users’ existing balances and new deposits of USDC, USDP, and TUSD stablecoins will be automatically converted to BUSD at a 1:1 ratio.

- Binance marketed this maneuver to outcompete rivals as a new exchange’s feature called “BUSD Auto – Conversion“.

- Changpeng Zhao stated that this was not a delist as many had thought. You may still deposit and withdraw the other stablecoins, although all liquidity is merged into one pair for a better price and lower slippage.

- The top-tier exchange claimed that this activity will enhance liquidity and capital efficiency for Binancians. Moreover, Binance has notified its users that the change won’t affect their preferred withdrawal method as they’d still be allowed to cash out in USDC, USDP, or TUSD. Besides, Binancians will be able to see the converted balance on their accounts after 24 hours post-conversion.

- The company will also restrict pot trading, futures, and margin lending for USDC, USDP, and TUSD products.

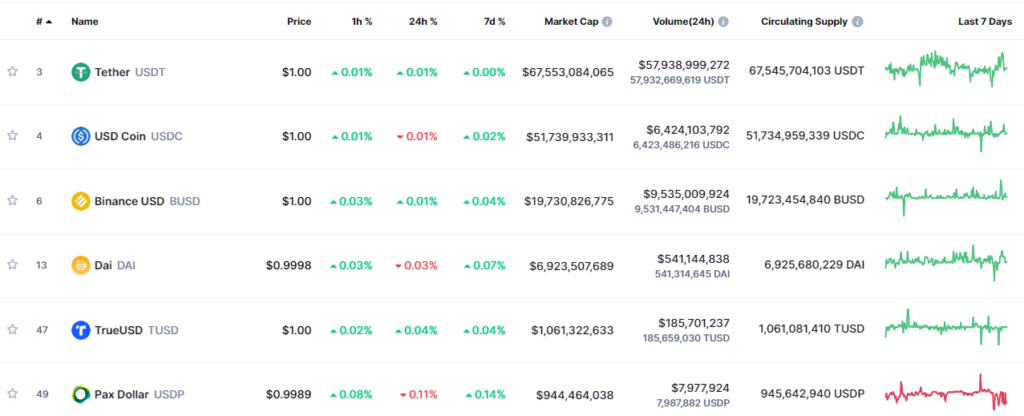

- This move of Binance to delist stablecoin competitors could bring Binance USD to second place. As of the time of writing, the BUSD market cap is 19.7 billion, sitting below USDC (51.7B) and USDT (67.6B). Furthermore, Binance statistics show that this platform has around 30 million users, this move will certainly hit severely BUSD contenders.

- As crypto markets has been falling intensively, stablecoins have become a popular alternative. Stablecoins are essentially versions of fiat currency that developers design to provide stability while minimizing volatility.

See Related: Binance Announces Taxi Integration On Its App, Payable In BUSD

#Binance to Auto-Convert $USDC, $USDP, $TUSD to #BUSD (Binance USD).

— Binance (@binance) September 5, 2022