With no central authority behind Bitcoin, the more than 500 crypto exchanges worldwide use their own order books to base its price, although this brings up a key problem which tends to vary the price of BTC from one exchange to another.

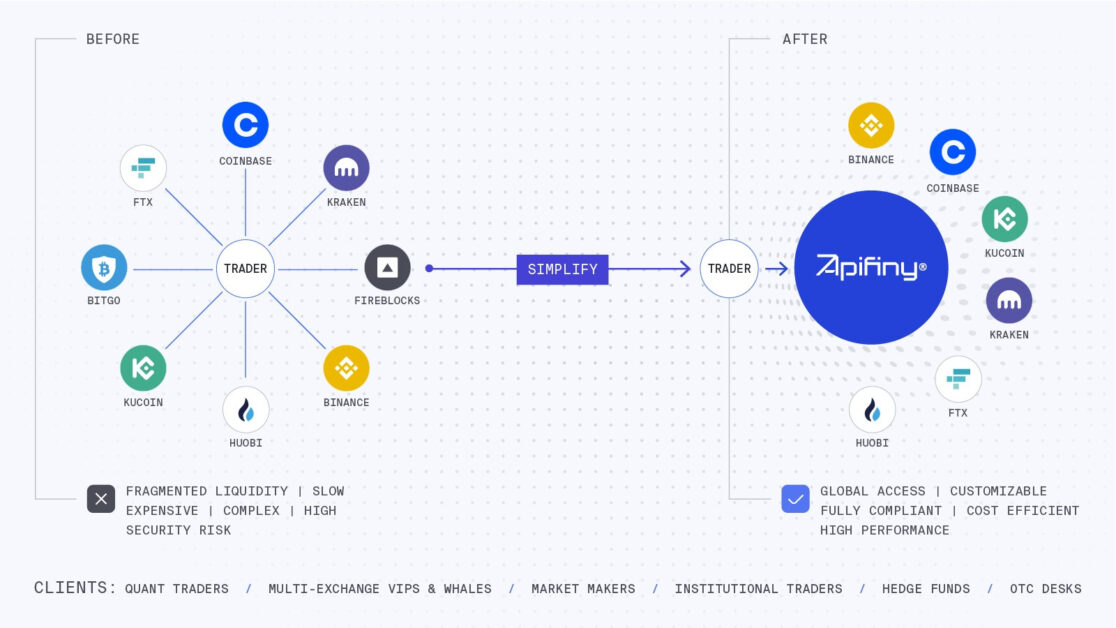

- Haohan Xu, the CEO of Apifiny, described in an interview how Bitcoins market fragmentation as “disconnected and scattered crypto markets” as exchanges are split into regions worldwide. Therefore, the price of Bitcoin depends on the region’s demand and supply. As a result, it creates isolated liquidity pools for Bitcoin.

- Xu added that these crypto exchanges make it difficult for investors and traders to get the best price for Bitcoin and other major cryptocurrencies at a particular time.

- Bitcoin is also facing liquidity challenges, especially in a bear market where the price of Bitcoin is difficult to predict. Hence, several cryptocurrency exchanges engaged in borrowing and lending crypto assets are suspending withdrawals and ultimately filing for bankruptcy.

See Related: Celcius Files For Bankruptcy Revealing A Billion Dollar Deficit

- Haohan Xu calls for regulations to fix the market fragmentation of cryptocurrencies – namely Bitcoin. He also believes a smart order routing tool can provide the best price execution with enough liquidity from top cryptocurrency exchanges.