Bitcoin has overtaken the Russian Ruble in total market capitalization.

Market analysts believe Bitcoins price surge was partly fuelled by Russians exchanging Rubles to cryptocurrencies. Along with the fact cryptocurrency serves as a store of value during times of uncertainty.

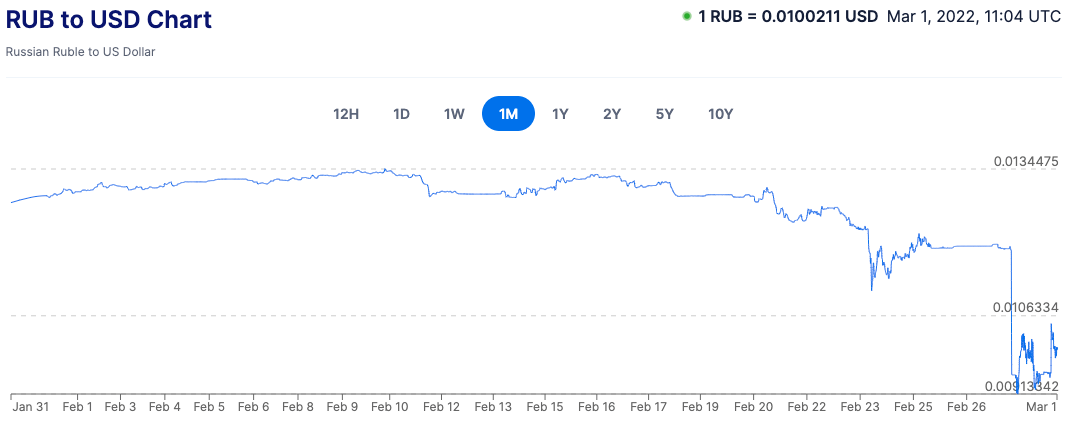

In turn, the crash of the Ruble came after increased sanctions imposed by nations after Russia’s invasion of Ukraine. The banning of Russian banks from the SWIFT payment system also played a major role.

“The defining characteristics of bitcoin allows it to act as a safe haven during turbulent times.”

Paolo Ardoino, CTO of BitFinex

The Russian Ruble has hit a 30 year low, losing over 30% of its value in less than a week, 1 Russian Ruble is worth a mere US$0.01.

The Impact Of War On Currency

Russia’s invasion of Ukraine has sent markets into a whirl. Although international markets managed to recover mere days after the initial invasion, the most affected country is still Russia themselves.

In response to the sanctions and bans imposed on Russia, Russia’s central bank more than doubled its interest rates to a crazy 20%. This was done in an effort to “maintain financial and price stability” stated the central bank.