In light of FTXs bankruptcy, various exchanges have pledged to provide a Proof-of-Reserves audit to prove that they have the assets they claim to have.

- Crypto.com CEO, Kris Marszalek, had shared some of the companies cold wallet addresses for the top assets on their platform. “Please expect a full audited Proof of Reserves from us in the next couple of weeks, confirming the full 1:1 reserve of all customer assets,” he added.

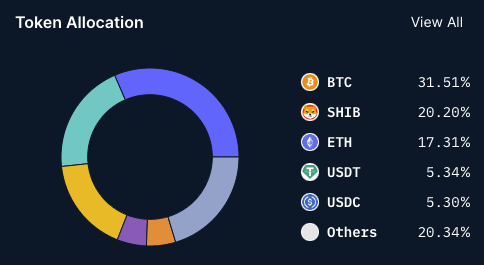

- The total holdings of the CryptoCom wallets as of now is $2.84B, with the most popular tokens being BTC, SHIB, ETH, USDT, and USDC amongst others. Their BTC address has around 53,024 Bitcoins currently worth ~$896M. Additionally, their ETH address holds around 391,564 Ether worth ~$503M, with an additional ~$1.39B in ERC-20 tokens.

- The analytics show that 66.54% of assets are on the Ethereum chain, 31.51% of assets are on the Bitcoin chain, 1.45% of assets are on the BNB Chain, 0.51% of assets are on Polygon’s chain, and the rest are split amongst Avalanche and various other chains.

- Many exchanges have vouched to reveal proof-of-reserves after Binance’s Changpeng “CZ” Zhao tweeted that “All crypto exchanges should do merkle-tree proof-of-reserves,” in the aftermath of FTXs downfall which had used users funds as collateral which they then defaulted on causing the previously second largest exchange to file for bankruptcy.

See Related: From Bad To Good To Worse: The Binance And FTX Saga