Investors are bracing for a reality check on whether higher interest rates will continue boosting European bank profits or if the year-long rally in banking shares could soon run out of steam.

This week marks the start of the first quarter earnings season for major European lenders. Britain’s Lloyds Banking Group kicks things off on April 24, followed by French giant BNP Paribas, Germany’s Deutsche Bank, and Britain’s Barclays on April 25, according to Reuters reports.

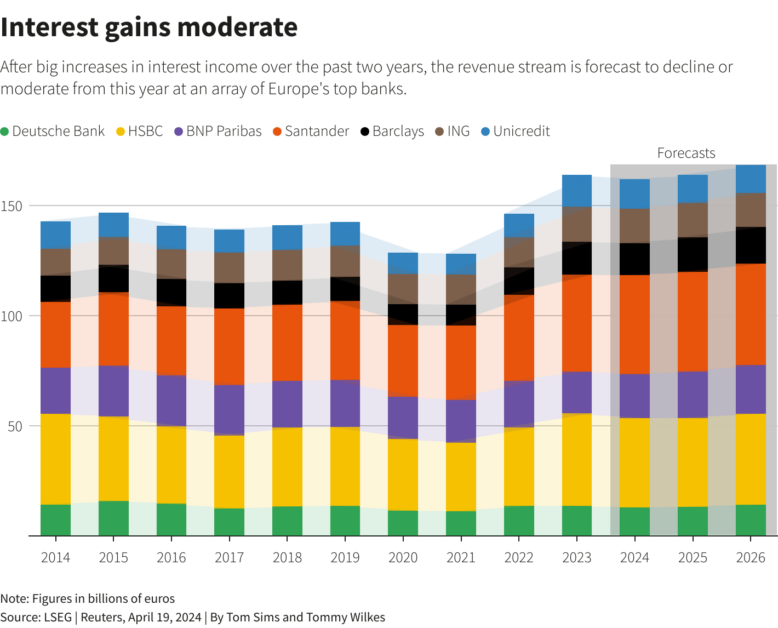

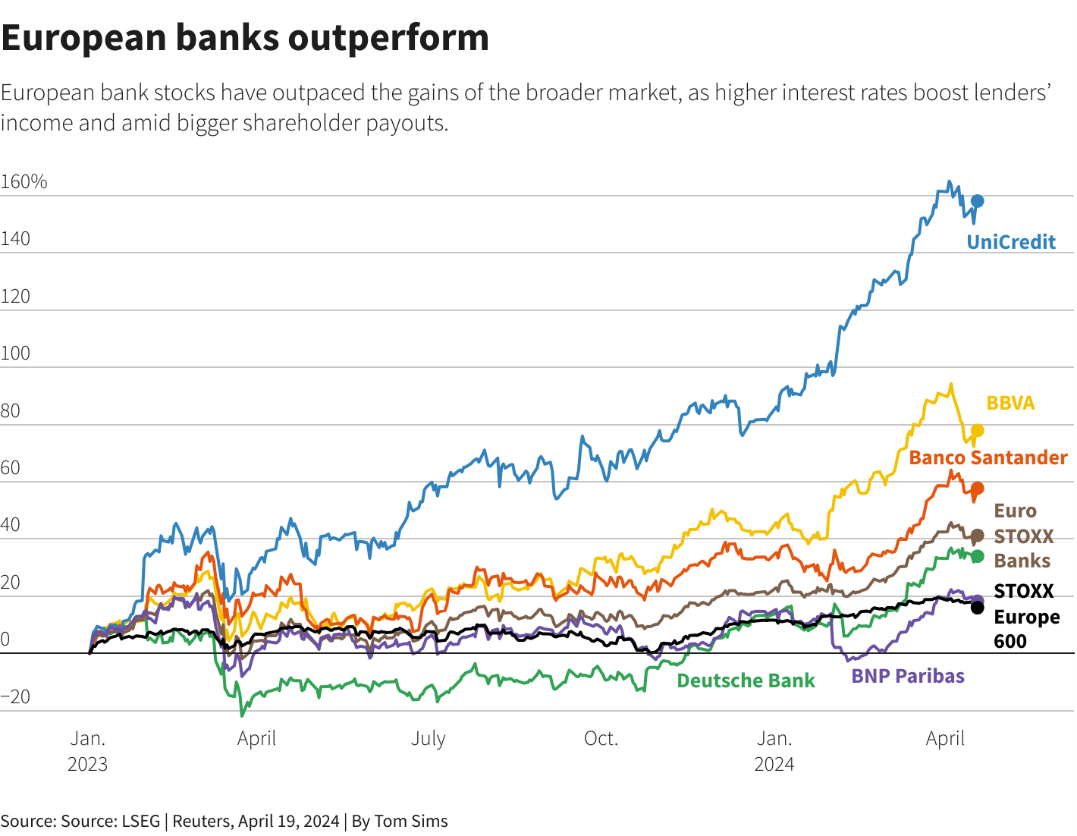

After years of ultra-low rates, surging borrowing costs have been a game-changer for European banks and their ability to profit from higher lending margins. This tailwind has supercharged bank stocks and investor payouts.

As quoted by Reuters in their analysis on the topic, Co-Head of Europe at consulting firm Oliver Wyman points out the fundamental difference is that Europe has moved away from negative interest rates. This shift has profoundly impacted the outlook for banks in the region, an impact that continues to be felt. The move to positive rates represents a game-changing development for European lenders after years of operating in a negative rate environment.

However, the full European banking picture won’t emerge until later in April and early May when Spanish giants BBVA and Santander and France’s Societe Generale and Swiss bank UBS report results.

While recent reports from Nordea and Bankinter signal earnings growth remains solid, Oliver Wyman’s Edelman cautioned that falling margins and weak loan demand could spell trouble ahead.

See Related: Tether Ordered To Reveal USDTs Exact Backings

Analyst’s Expectations

Most analysts still expect a strong first quarter as the higher rate environment and controlled bad loans provide tailwinds. Deutsche Bank is forecasting its 15th consecutive quarterly profit, while BNP Paribas’ typically strong first quarter could get an added boost from lower rate cut expectations.

However, the economic underperformance of Europe versus the U.S. and likely rate cuts this year by the Bank of England and European Central Bank could start weighing on lenders’ performance. Sustained high rates could also exacerbate problems in the struggling commercial real estate sector.

The coming weeks will prove crucial in determining if soaring bank shares can sustain their impressive run or if darker clouds are forming on the interest rate horizon. A potential shift in the rate cycle could present challenges and opportunities that will test the resilience of the European banking sector.