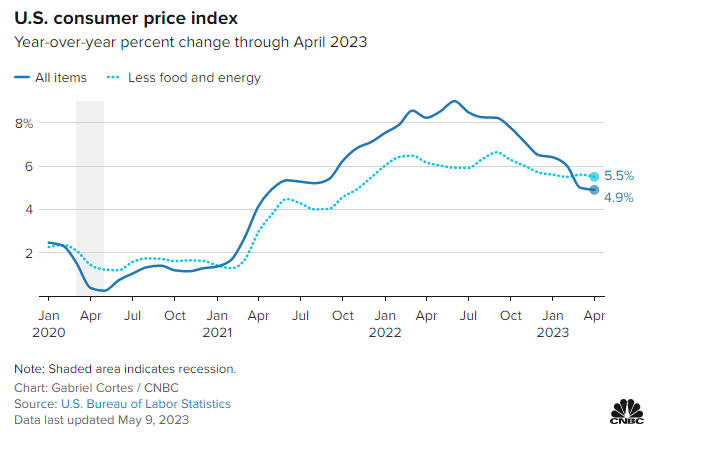

The U.S Bureau of Labor Statistics reported this Wednesday that Consumer Price Index (CPI) rose 0.4% month-on-month (m/m) in April, meeting the consensus forecast, while the 12-month change slipped to 4.9% – down from 5.0% in March. It is important to mention that increases in shelter, gasoline, and used vehicles pushed the index higher and were offset somewhat by declines in prices for fuel oil, new vehicles, and food at home.

The CPI reading has cooled considerably since peeking out around 9% in June 2022, and Wednesday’s report suggests that the Fed’s campaign to quell inflation is working. Starting in March 2022, the U.S. Federal Reserve has enacted ten consecutive interest rate increases totalling five percentage points. Financial markets reacted positively to the news that showed the prices urban consumers pay for a basket of goods and services are cooling down.

A core measure that strips out volatile food and energy prices remained flat at 0.4% on a monthly basis, but of the six grocery store indexes the Bureau of Labor Statistics uses to compute food prices, four showed declines. Milk, for instance, fell 2%, the most significant monthly drop since February 2015. Egg prices, one of the biggest gainers in the food index over the past year, fell 1.5%, taking the annual gain down to 21.4%.

Another positive news is that the Labor Department reported this Thursday that the Producer Price Index cooled more than expected in April. Producer Prices Index measures the prices U.S. companies get for their goods and services at the figurative factory door shed an encouraging 0.3 percentage point to 3.4% year-on-year. Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, added:

“For the second day in a row, we have good inflation data – both the CPI and PPI continue to come down – which should give the Fed the room it needs to take a pause at the next meeting.”

Signs of cooler inflation could support a rate pause in June, but investors should keep in mind that inflation remains far above the Fed’s target, and the path to 2% will be bumpy. Oxford Economics Lead U.S. Economist Oren Klachkin said:

“We think the Fed will maintain a hawkish bias through year-end and won’t hesitate to raise rates again if inflation and the labor market data surprise strongly to the upside.”

The federal funds rate is now from 5% to 5.25%, the highest level since 2006, and economists are worried that the high-interest rates will push the economy into a recession. The famous investor Jeremy Grantham warned that the U.S. stock market could experience significant losses soon, and a recommendation is that investors should continue to take a defensive investment approach.

Stocks aren’t the only assets that could significantly lose their value. Investors should remember that cryptocurrencies could also be in the situation to make an even bigger fall. The crypto market displayed a high correlation with U.S. equities. If a downtrend is witnessed in the stock market, the same is usually replicated in the crypto-sphere as well.