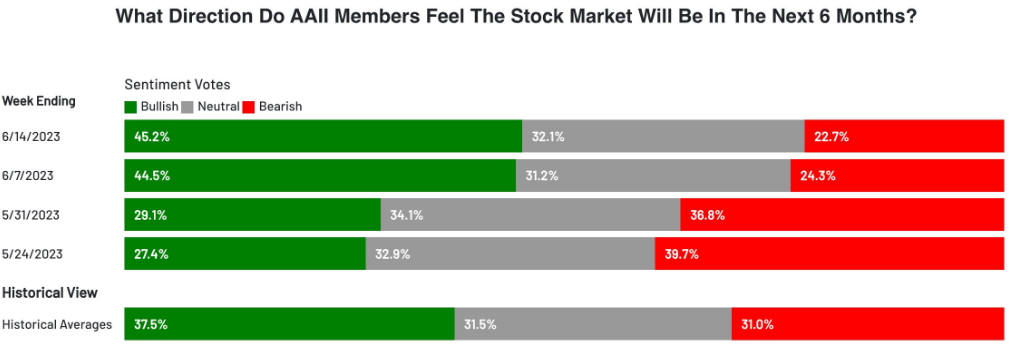

According to the latest American Association of Individual Investors(AAII) survey, Investor confidence is at a peak reaching a 19-month high. American Association of Individual Investors also reported that bearish sentiment fell to a 23-month low, and there is general expectation that the stock prices would rise over the next several months. The crypto market displayed a high correlation with U.S. equities. If a positive trend is witnessed in the stock market, the same is usually replicated in the crypto-sphere as well.

The University of Michigan’s Surveys of Consumers released data on Friday, showing that consumer sentiment in the U.S. improved to a four-month high in June. This is also positive news, and the improved view reflects greater optimism after signs of easing inflation, economic resilience, and a better-than-expected earnings season in the U.S.

Recent inflation data signalled that the Fed’s monetary tightening is cooling the world’s largest economy, and according to many analysts, the Federal Reserve is near the end of its tightening cycle. The U.S. economy remains stable even though the federal funds rate remains at its highest since 2007; the U.S. banking system is sound and resilient; job gains have been substantial, and the unemployment rate has remained low.

THIS TUESDAY, the U.S. Commerce Department reported that groundbreaking new American homes jumped by 21.7% in May 2023 to 1.63 million units. Building permits, considered among the housing market’s most forward-looking indicators, increased more than expected in May, rising 5.2% to 1.49 million units at a seasonally adjusted annualized rate. Kieran Clancy, Senior Economist at Pantheon Macroeconomics, said:

“The most forward-looking housing indicator is the stock market, which reflects where investors see the sector headed over the next six to twelve months. The ongoing bounce in housing starts and new home sales, and the surge in homebuilders’ stock prices fuel the emerging narrative in parts of the commentariat that housing is now recovering.”

However, investors should remember that the U.S. economy didn’t escape the recession, and it is still unclear how long interest rates could stay at the 5% plus level. The inflation remains far above the Fed’s target; the path to 2% will be bumpy, and the Fed will not hesitate to raise rates again if inflation data surprised enormously to the upside.

Because of this, many analysts expect a significant economic contraction which will impact corporate earnings and financial markets. Wells Fargo analysts said that over the next 3-5 months, they hope to see a 10% correction on the U.S. stock market. If this happens, it would certainly negatively influence the cryptocurrency market.