The second-quarter earnings season has shifted into high gear, with Alphabet (GOOG) and Tesla set to report their results after the bell on Tuesday. The big question is if tech-related megacaps can maintain their recent strong earnings growth and whether this growth is starting to extend to other sectors.

Corporate profits are emerging as the big driver of what the market is likely to do in the near term, and if earnings results fall short of expectations, the stock market’s reaction could be severe. Conversely, positive earnings can drive investor optimism, leading to increased buying activity and higher stock prices.

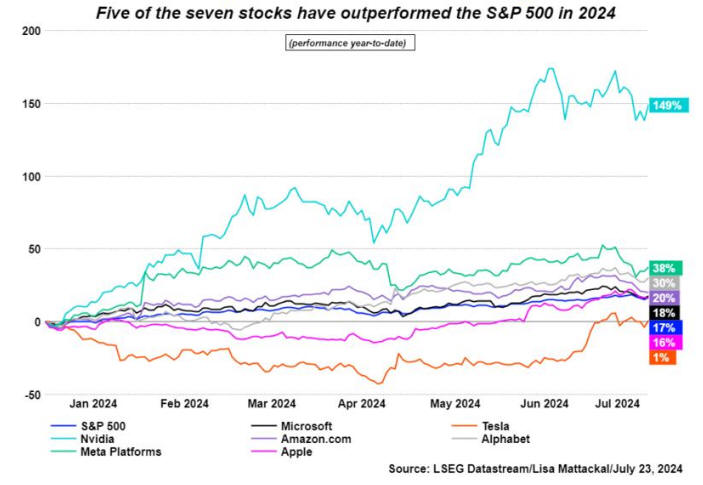

Investors are closely monitoring second-quarter U.S. earnings and it is important to say that earnings for the quarter are now estimated to have increased 11.5% in the quarter, according to LSEG data Tuesday. That’s up from growth of 9.6% estimated on July 12 and this latest forecast is based on results from 102 of the S&P 500 companies and estimates for the rest.

See Related: Wall Street’s Main Indexes Fell As Alphabet’s Projections For Rising AI Costs Dented Most Mega-Cap And Chip Stocks

LSEG Report On S&P 500 Companies

LSEG also reported that of the 102 S&P 500 companies that have reported quarterly results so far, more than 80% of them have beaten expectations. Phil Blancato, CEO of Ladenburg Thalmann Asset Management, said:

“You’re looking at a scenario where (Big Tech) names are going to determine the direction of the market… So, if those names disappoint in any way whatsoever, markets will struggle. Their valuations are expensive and we could run into a problem if they don’t meet expectations.”

In the realm of economic data in the United States, this week’s releases include the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred measure of inflation. This report will be critical for assessing the outlook for monetary policy, especially in light of the recent downward trend in inflation and indications that the labor market is starting to cool.

The positive news is that bets of a 25-basis-point interest-rate cut by September have shot up to nearly 94%, from nearly 60% last month, according to CME’s FedWatch Tool. Meanwhile, a Reuters poll indicates that the Federal Reserve is anticipated to reduce interest rates twice this year, with cuts expected in September and December.