Investors continue to observe comments from Federal Reserve officials that could give more insight into the path of interest rates, but it is important to say that the U.S. Central Bank is widely seen raising rates by 25 basis points at its meeting this Wednesday, although the consumer prices and producer prices data provided evidence that inflation cooled more than expected.

The US economy is doing better than expected, but inflation is still higher than the target of 2%. The latest economic data, corporate earnings, solid job market, and consumer sentiment cemented this expectation, and according to analysts, the U.S. economy still has some vibrancy, which gives the Fed cover to continue its rate hike policy.

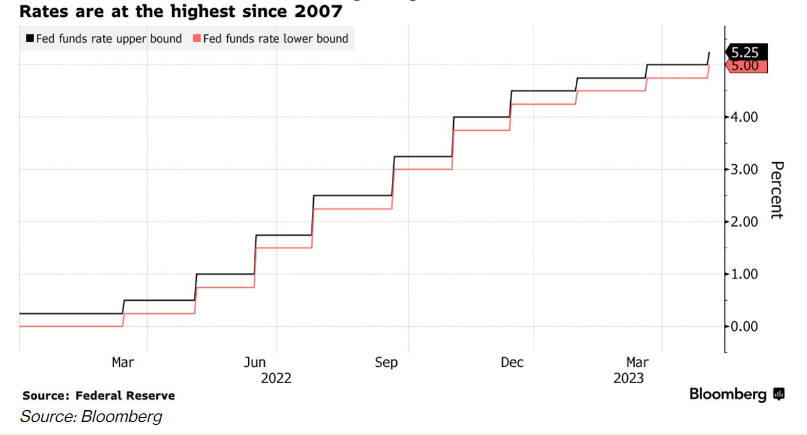

Markets are pricing a 90% chance that Fed policymakers will raise interest rates by 25 basis points on July 26. Still, there is also a significant chance that interest rates will stay unchanged at the September, November, and December meetings. The federal funds rate is at 5% to 5.25%, the highest since 2007, but financial and tech stock gains still supported Wall Street shares.

With higher interest rates, companies need to spend more money to borrow money to invest in growth, but as long the U.S. economy is not in recession and the corporate profit remains healthy, there is no risk of a bigger sell-off on the stock market. The recent rally in the cryptocurrency market was also connected with the positive sentiment on the stock markets, and the strengthening correlation between crypto prices and stock prices indicates crypto’s maturity.

The S&P 500 is up to nearly 20% year-to-date, while the Nasdaq has advanced about 37%, and both indexes are on track for their fifth straight month of gains. Corporate earnings so far are coming in pretty well, and Alphabet (Google), Microsoft, Visa, AT&T, Coca-Cola, Meta, Boeing, Procter & Gamble, Exxon Mobil, McDonald’s, Ford, and Intel are among the companies scheduled to report quarterly results by the end of this trading week.

A positive financial performance among these companies could lift shares on Wall Street and investors will watch guidance carefully from these companies to determine if profit margins remain healthy. The International Monetary Fund raised its global economic outlook for 2023 due to strong activity in the services sector in the first quarter.