Table Of Contents

What Are Tokenomics?

Tokenomics is the study of tokens from an economic standpoint, identifying the factors which make a cryptocurrency valuable to an investor. Understanding the potential value of a token starts with the why and how it is intended to be used.

A token allows information and value to be stored, transferred, and verified within a blockchain. Physical and digital assets may be represented through a token.

At its basis, economics looks at supply and demand, scarcity, costs and benefits, and incentives. These 4 core concepts translate over into tokenomics, along with various other features. Tokenomics is a broad definition as it describes all the factors which go into a token, although there are core concepts behind the term.

The Aspects Of Tokenomics

Consensus And Governance dictate the direction a project is heading. Consensus relates to how decisions are made within the network and governance dictates how these changes are implemented along with how the system is run and managed. It is also worth reading up on the developers and their past histories and qualifications – if their information is public.

Token Supply refers to the total amount of coins that are/have been released to the public. There are 3 main token supply factors being circulating supply which is the number of tokens in circulation, total supply defines the tokens currently in and out of circulation, and the max supply which is the maximum number of tokens the specific crypto will ever create.[1]Yield App – What are tokenomics and why do they matter?

Token Distribution explains how tokens are distributed to the community and developers. This can be through an ICO, airdrop, or rewards for mining or staking. Tokens distributed to the developers are usually locked for a period of time to prevent scams and schemes and are released slowly to prevent a sudden flood of circulating supply.

Price Stability details how the inherent volatility and supply/demand of cryptocurrencies will be managed. This is done through various factors such as token distribution, a well-tracked depository, and token use which incentivizes trading on utility rather than security/hype.

Why Are Tokenomics Important When Investing?

The tokenomics associated with a project will give a sense of how it will perform in the future and react to certain events. It is important to recognize and research these various factors prior to investing. The model must be both secure and durable as any weakness and inability to adapt could be exploited by bad players.

A project’s tokenomics should be found within its whitepaper, although not explicitly stated. This describes the features of a project, although a lot of whitepapers do not describe how its certain tokenomics would actually benefit the project. Other sites such as CoinMarketCap and CoinGecko detail the basis of the tokenomics of a project.

Tokenomics In Action

Bitcoin’s Tokenomics

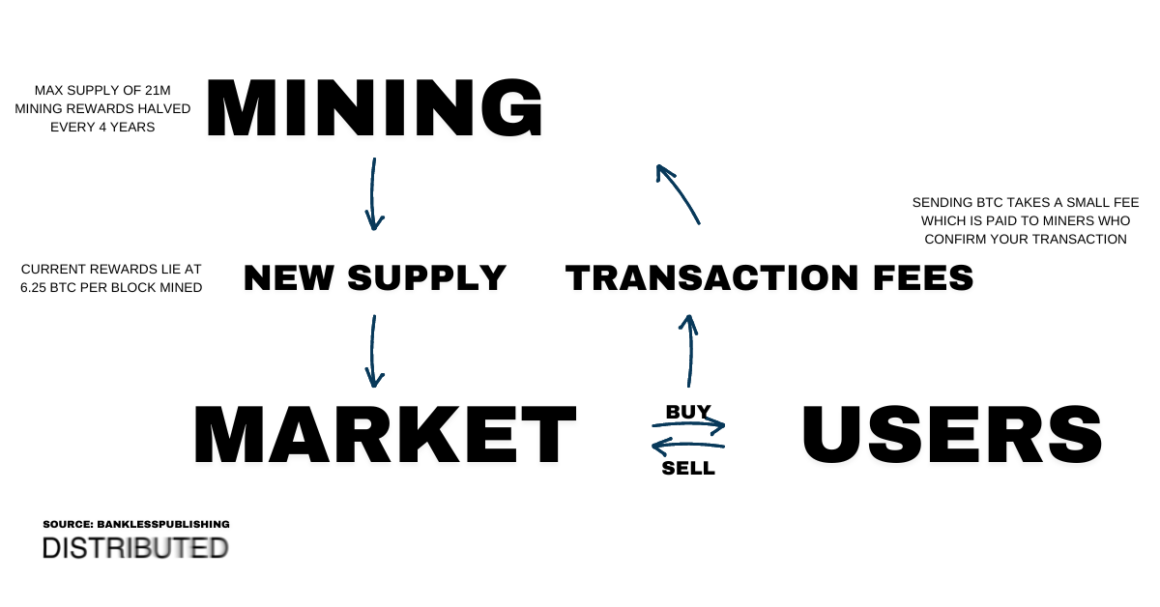

Bitcoin was the first of many digital currencies to combine a monetary policy with an economic model native to the internet. The tokenomics model was first outlined in the whitepaper published by the pseudonymous Satoshi Nakamoto in 2009. The whitepaper defined how Bitcoin would be a peer-to-peer electronic system that used blockchain technologies to secure its ledger and computing power to confirm whether transactions are legitimate in an immutable way.

By incentivizing miners to secure the network in exchange for native tokens of the network through transaction fees, Satoshi created an asset secured by nothing more than cryptography and computers – one of the first economic models of its kind and never seen in functioning before in financial markets. Following the inflationary pressure created by the 2008 financial crisis, Bitcoin came at a time when there was large mistrust with centralized entities, which allowed it to thrive among those who believed in a decentralized future before it gained mainstream adoption.

Ethereum’s Tokenomics

Ethereum is the next biggest thing after Bitcoin. Launched in 2015, Ethereum promised to provide a blockchain containing a Turing-complete programming language – a digitally native supercomputer. The programming language called Solidity enabled the creation of smart contracts, non-fungible tokens, and crypto assets independent of Ethereum but secured by its blockchain.

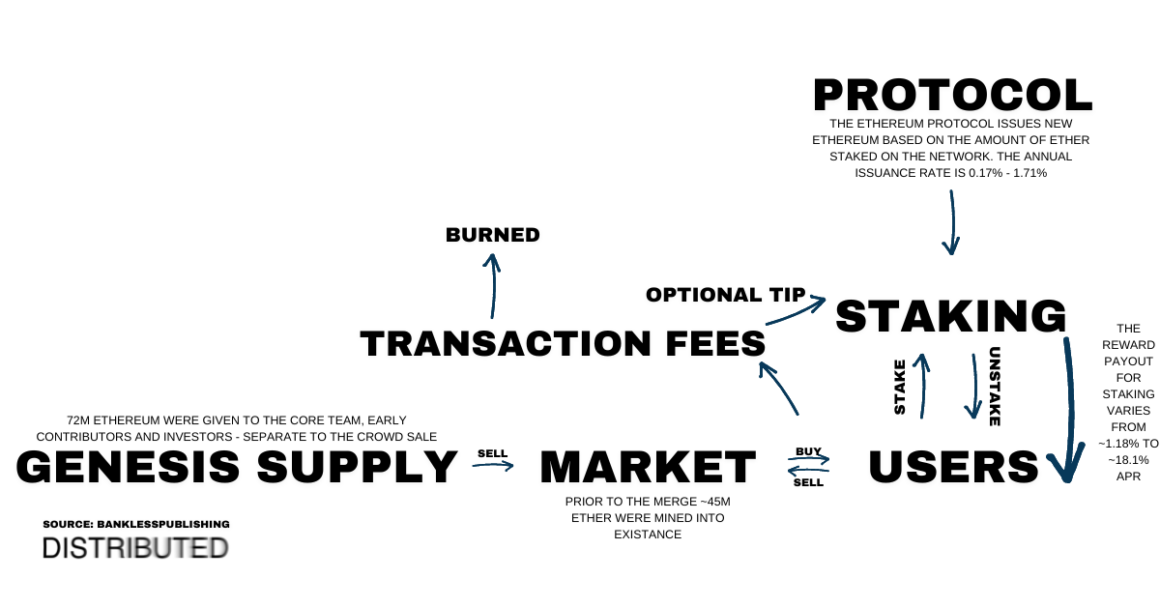

Bitcoin and Ethereum started quite similarly, secured by a Proof-of-Work consensus mechanism. However, Ethereum recently merged its old PoW blockchain with a newer Proof-of-Stake chain which cut its energy consumption by over 99.95% and made the system more scalable.

The tokenomics surrounding the native token Ether are as follows; 83.33% of tokens were sold in a crowd sale, and the remainder was given to the core team surrounding the project. Ether doesn’t have a supply limit, although the token has an annual supply rate of ~4.5%, handed out as staking rewards to network users. After implementing EIP-1559, a base fee was introduced to transaction fees which are then burned to keep the token deflationary. The network adjusts this fee automatically based on the supply and demand of the network’s capabilities.

References