The Treasury market is preparing for a game-changing event. Market participants are anxiously awaiting the finalization of a major rule by the U.S. Securities and Exchange Commission (SEC), aimed at reigning in debt-fueled bets by hedge funds while bolstering financial stability. However, they also harbor concerns that this new rule could reshape the industry and create unanticipated challenges.

Implementation of New Rules

The SEC’s rule, initially proposed in September of the previous year, intends to shift a significant portion of trading activity in the colossal $25 trillion Treasuries market, including the short-term financing sector known as repurchase agreements (repo), to central clearing. In the central clearing, a clearinghouse acts as the intermediary, becoming the buyer to every seller and the seller to every buyer.

Market insiders widely anticipate the SEC to finalize this rule within the coming weeks, possibly as early as mid-November. However, essential details remain unclear, such as whether the SEC intends for the industry to transition to central clearing in one sweeping move or allow it to occur gradually in phases. The timeline for implementation is also uncertain, leaving industry participants in suspense.

The rule emerges amidst a backdrop of recent regulations that have prompted banks to withdraw as intermediaries from the Treasury market. This withdrawal has contributed to some of the issues the SEC aims to address. The industry is apprehensive that central clearing, if executed poorly, might increase costs, potentially leading to more traders exiting the market.

Future of the Industry

The impact of this rule on the industry remains enigmatic. Recent developments suggest a diverse approach among market players. JPMorgan Chase has reduced its position in the repo market segment where the SEC seeks to encourage banks to increase their presence. In contrast, custody banks such as Bank of New York Mellon and State Street have been actively expanding in these areas. This contrasting trend in the industry’s response has not been previously reported.

The rule’s implications extend to various market participants, including independent brokers. Some hedge funds relying heavily on borrowing to capitalize on slight Treasury price differences could find their trades no longer profitable under the new regulations.

According to experts, the new rules come with embedded costs. The distribution of these costs remains a pressing question for the industry.

Mixed Signals

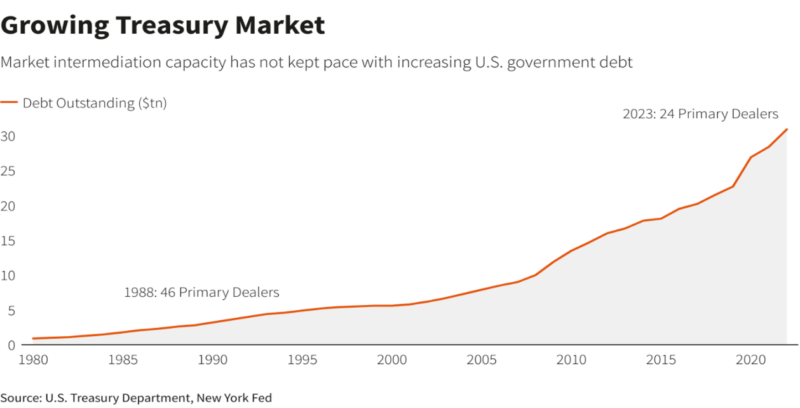

In recent years, the Treasury market’s foundation has shown signs of strain. Despite the growth in U.S. government debt, the number of buyers has dwindled. Banks have scaled back their involvement due to heightened capital requirements that have made trading less attractive. Hedge funds and proprietary traders have filled the void, but they come with a higher risk profile and can withdraw during times of market stress.

The pivotal moment occurred in March 2020, when the Treasury market experienced a near-seizure during the height of the pandemic. This required the Federal Reserve to intervene with emergency measures. Experts anticipate that some of these emergency measures could become permanent fixtures in the market.

The regulatory landscape was shaken, leading to a review of market functioning by U.S. regulators. The SEC’s rule stands as the most significant outcome of this review. There is a consensus regarding the need for reform in the Treasury market, with central clearing being seen as a beneficial step to improve financing and reduce market turmoil.

Although some industry experts acknowledge the need for reform, they do emphasize that the success of the rule depends on its implementation and the associated costs. The industry remains uncertain about what these costs might entail and how they will manifest.

Hidden Answers

One specific concern revolves around the repo market, where investors borrow short-term cash against Treasuries. Most trading in this market occurs bilaterally between brokers and customers, such as hedge funds. The SEC’s rule would compel banks to shift this trading to central clearing. However, hedge funds lack direct access to the market’s central clearing agency, necessitating banks to provide access through sponsorship. This process incurs additional costs, which banks must decide whether to pass on to their clients.

Data shows that JPMorgan has reduced its positions in sponsored repo trading, while Bank of New York Mellon and State Street have expanded their presence. With limited data available, financial statements offer valuable insights. Banks employ netting to offset some of their lending and borrowing activities in the cleared market. Netting has grown substantially for custody banks.

As industry participants brace for the seismic changes ahead, one thing is clear – the Treasury market is on the cusp of transformation. How these changes unfold will determine the market’s future and the costs and challenges it may bring. While the necessity for reform is widely acknowledged, the devil is in the details, and it remains to be seen how the SEC’s rule will shape the Treasury market’s destiny.