The Federal Deposit Insurance Corporation (FDIC) reported last week that U.S. bank profits and deposits remained steady during the second quarter of the year, suggesting a return to stability in the sector. This comes after a period of turmoil earlier in the year. However, regulators are closely monitoring unrealized losses, indicating that challenges persist.

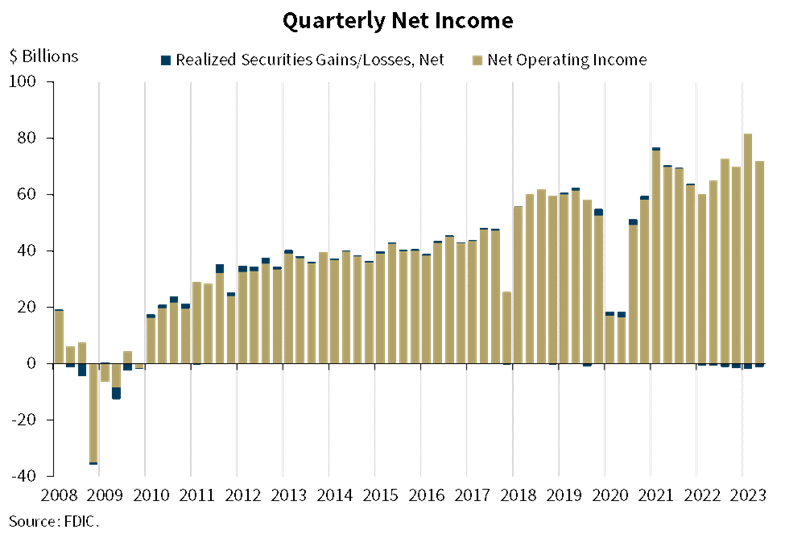

Overall industry profits in the second quarter fell by 11.3% year-on-year, amounting to $70.8 billion. This decline was driven by the acquisitions of Silicon Valley Bank (SVB) and two other large lenders, which faced difficulties between March and May. These banks experienced cash withdrawals by depositors, impacting their profitability. When excluding these acquisitions, profits saw a 5.7% increase compared to the previous year.

While deposits have declined for the fifth consecutive quarter, the rate of decline slowed significantly in the second quarter. Deposits were down by just 0.5%, in contrast to the steep 2.5% decline observed in the first quarter. The decline in deposits was primarily driven by uninsured deposits, whereas insured deposits saw a modest increase of 0.8% in the second quarter.

A key area of concern remains the level of unrealized losses on securities. In the second quarter, these losses increased by 8.3%, reaching a total of $558.4 billion, as reported by the FDIC. It’s worth noting that this increase follows two consecutive quarters of declining unrealized losses. The earlier crisis was triggered by Federal Reserve interest-rate hikes, which negatively impacted banks’ U.S. Treasury securities portfolios and unsettled depositors.

Continued Monitoring and Potential Rate Hikes

The FDIC’s report includes data related to the failure of First Republic Bank, which was taken over by regulators in May and subsequently sold to JPMorgan Chase. Additionally, the FDIC’s “problem bank” list remained unchanged, with 43 firms on the list for the second quarter.

The latest FDIC report offers a glimpse of the U.S. banking sector’s ongoing journey toward stability after a turbulent period. The industry remains vigilant in monitoring potential challenges while adapting to changing economic conditions.