Federal Reserve Chair Jerome Powell said this week that recent inflation data has not given policymakers enough confidence to ease monetary policy soon, noting that the U.S. central bank may need to keep interest rates higher for longer than previously thought.

The latest inflation data showed that U.S. consumer prices rose more than expected in March and with rising costs for gasoline and shelter, the U.S. consumer price index rose 0.4% last month. This marked a 3.5% year-on-year rise while economists surveyed by Reuters had projected a monthly increase of 0.3% and a 3.4% year-on-year gain.

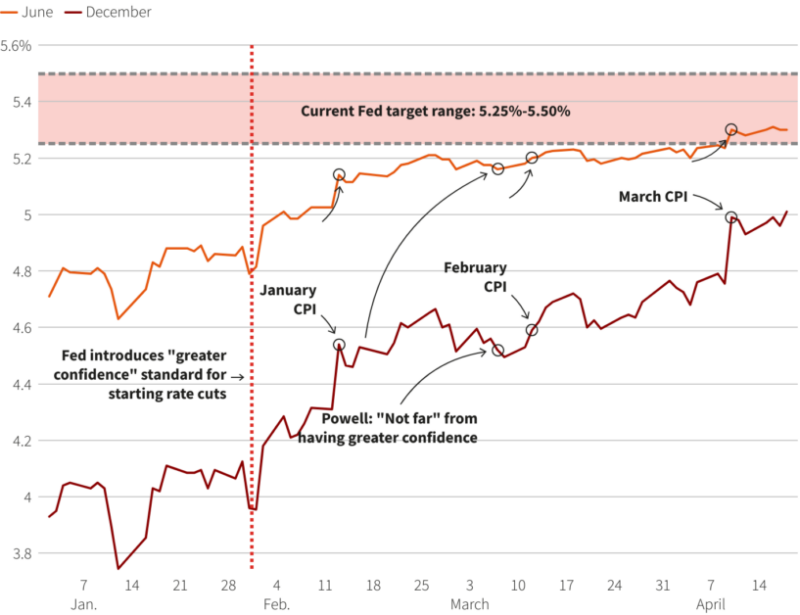

As a result, traders reduced their expectations for rate cuts, now indicating approximately a 17% likelihood that the Federal Reserve will decrease rates in June, compared to around 62% just a week earlier. CME Group’s FedWatch tool also reported that traders reduced expectations for a July cut to 41% from approximately 76% last week. Michael Hans, chief investment officer at Citizens Private Wealth, said:

“We’re in this volatile sticky point right now where the Fed wants to see more data points to give them confidence they’ll achieve their 2% inflation goal. The market is reacting because there were much higher expectations coming into this data that there would be a cut in June or July.”

See Related: Bitcoin and Ethereum Price Prediction After Inflation Increased Above Expectations

Retail Sales Report

Meanwhile, a report released on Monday showed that retail sales expanded beyond expectations in March, signaling the resilience of the U.S. economy, which contributed to driving benchmark U.S. 10-year Treasury yields to their highest levels in five months on Tuesday.

James St. Aubin, chief investment officer at Sierra Mutual Funds in California said that market participants are currently trying to balance this two-sided narrative: U.S. economic growth, which looks good, and at the same time the inflation picture, and interest rates, which will eventually be problematic for the stock market.

Some economic analysts said that the U.S. central bank became too focused on inputs after misreading inflation in 2021 and they warned that the Fed risk a recession if it cut rates later than June. Simultaneously, the increase in geopolitical uncertainties presents an extra hurdle and amplifies the possibility of unexpected risks in both markets and economic outcomes and the recommendation for investors is to take a defensive approach in the weeks ahead.