Shares on Wall Street continue to be supported, led by gains in financial and technology stocks, with investors looking toward the next round of quarterly results as earnings season gets underway. The S&P 500 is up to nearly 19% year-to-date, while the Nasdaq has advanced about 37%, and both indexes are on track for their fifth straight month of gains.

Some of the largest U.S. banks, including JPMorgan Chase and Wells Fargo, reported a profit boost from higher rates, pointing towards a resilient economy. This Tuesday, Bank of America posted a 20% surge in second-quarter profit, and it is also important to mention that Morgan Stanley’s stock had today the most significant single-day gain since late 2020, after its second-quarter profit and revenue beat analyst expectations on a boost from its wealth management business.

According to Refinitiv data, of the 30 companies in the S&P 500 that reported earnings last week, 80% beat analyst expectations. Corporate profits are emerging as the big driver of what the market is likely to do in the near term, but if earnings results fall short of expectations, the stock market’s reaction could be severe. Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, added:

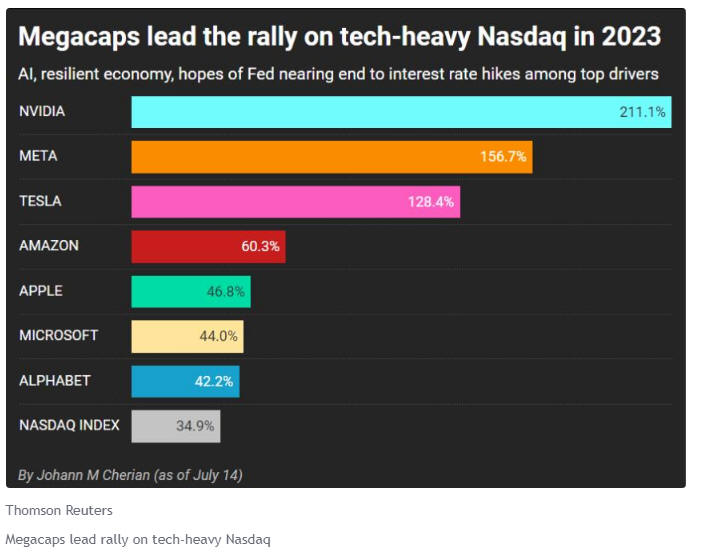

“Investors are looking at the fact that the economy has been resilient, and corporate earnings so far are coming in pretty well. The tech-heavy Nasdaq led Wall Street higher, supported by mega-cap growth stocks including Apple and Tesla, ahead of quarterly results from industry heavyweights through the week.”

Goldman Sachs, International Business Machines (IBM), Netflix, Tesla, Blackstone (BX), Johnson & Johnson, Philip Morris International (PM), Newmont (NEM), and American Express are among the companies scheduled to report quarterly results by the end of this trading week. A positive financial performance among these companies could lift shares on Wall Street even more, and investors will watch guidance carefully from these companies to determine if profit margins remain healthy and strong.

In the days ahead, the U.S. stock market will also be hypersensitive to FED comments. However, prices and producer prices data provided evidence that inflation cooled more than expected, stoking hopes that the U.S. Federal Reserve will soon end its monetary policy tightening. However, markets are pricing a 90% chance that Fed policymakers will raise interest rates by 25 basis points on July 26. Still, there is also a great chance that interest rates will stay unchanged at the September, November, and December meetings.