Triangular arbitrage is an advanced form of trading strategy that seeks to exploit price differences between three cryptocurrencies on the same trading platform. First discussed in stock and foreign exchange markets, it is more common in Bitcoin because of the intrinsic volatility and inefficiencies of the market. In this article, triangular arbitrage will be deepened; an attempt will be made to explain how this type works, its advantages and disadvantages, and its future in online trading.

What is Arbitrage?

It is a form of financial practice whereby traders take advantage of the price difference for the same asset across more than one exchange for their benefit. Such differences arise because of market inefficiencies and unstable supplies and demands. For example, the value of a cryptocurrency like MATIC by Polygon may be slightly different between Uniswap and PancakeSwap.

By taking advantage of these differences, arbitrageurs can also purchase low in one and sell high in another. Indeed lucrative but tiring to analyze and quickly execute since the window for such a deal is narrow.

See Related: Osmosis DEX Halted After $5M Exploit

The Concept of Triangular Arbitrage

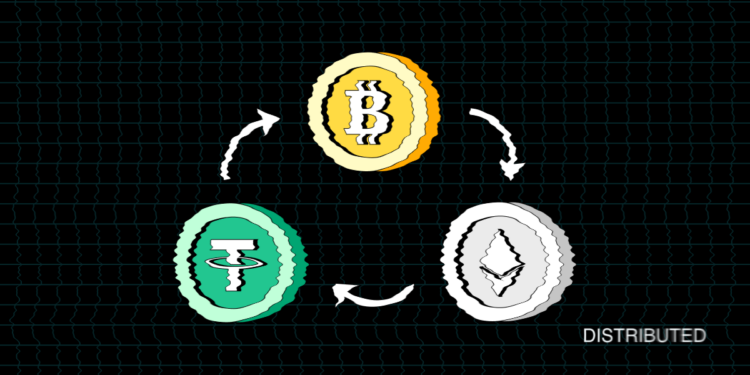

Triangular arbitrage is an extension of the aforementioned idea, but it uses three cryptocurrencies on one exchange. It relies on inequalities in the exchange rate between the three currencies.

For instance, sell Currency A for Currency B, then sell Currency B for Currency C, and finally use Currency C to buy Currency A. You will realize a profit if the differentials in the exchange rates have gone your way.

Key execution methods include:

- Buy-Buy-Dispose

- Acquisition-Sale-Re-acquisition

- Sell-Sell-Buy

This approach necessitates sophisticated analytical abilities to recognize opportunities and implement trades promptly, given the rapid fluctuations in cryptocurrency prices. Automated instruments, commonly referred to as bots, are frequently utilized to enhance the efficiency of the process and mitigate human error.

Triangular arbitrage is legal in most jurisdictions. However, this does not make it legal to use illicit money to trade, as this would amount to money laundering.

Algorithmic Trading and Bots

Triangular arbitrage typically works through algorithmic trading bots. While this bot tracks many pairs of cryptocurrencies in real time, it executes trades at incredible speeds based on minor price discrepancies. That just boosts precision, making the process truly efficient through automation for the traders.

Triangular Arbitrage versus Statistic Arbitrage

Whereas triangular arbitrage focuses on the spread between the prices of three currency pairs, statistical arbitrage attempts to find a pattern by using historical price information and playing the correlations. Statistical arbitrage can also become long and short, many times depending on mean reversion for profits.

Triangular arbitrage is normally low-risk because the execution happens quite fast, whereas in statistical arbitrage, there may be higher risk because of longer holding periods and market volatility.

Advantages of triangular arbitrage

Better market transparency:

Increased trading activity for numerous pairs helps triangular arbitrage to provide market liquidity—permitting big trades with a small price impact.

Market Efficiency:

This strategy indirectly stabilizes cryptocurrency prices by correcting imbalances, promoting a fairer trading environment.

Profit Opportunities:

The broad network of triangular arbitrage, therefore, gives traders an opportunity to exploit different market conditions and anomalies in prices.

Risk Reduction:

This approach reduces the volatility of one particular cryptocurrency since it diversifies across many securities.

Possible Risks of Triangular Arbitrage

Liquidity Risk:

Inadequate liquidity can make the running of an essential transaction hard and costly.

Market inefficiencies:

Delays in execution or sudden changes in prices can disrupt this strategy and decrease profitability.

Slippage risk:

This makes triangular arbitrage prone to slippage due to the fast-paced nature; that is, trade execution prices fail to coincide with intended prices.

The Future of Triangular Arbitrage in Cryptocurrency

As technology and financial markets progress, it is anticipated that triangular arbitrage will become increasingly advanced and competitive. Improved tools and algorithms are likely to enhance the precision of trade execution; however, heightened competition may constrain profit margins. Additionally, regulatory changes could influence the viability and profitability of this trading strategy.

Traders willing to apply triangular arbitrage on their own to the dynamic cryptocurrency market will have to be flexible and creative.