In a move aimed at enhancing financial stability, the US Federal Reserve has proposed new rules that could revolutionize how we understand the risks lurking in the shadows of the US financial system. This development, as reported by Reuters, marks a significant step in regulators’ efforts to illuminate the often-opaque world of shadow banking.

Shadow banks, a term encompassing non-bank financial institutions like private funds and mortgage servicers, have long been a cause for concern among regulators and industry experts. Operating under lighter regulations than traditional banks, these entities have grown substantially, particularly as stricter regulations have made certain types of lending more costly for conventional banks.

The Fed’s proposal, published on June 21, aims to collect granular details about banks’ exposure to shadow banks. This move would allow the regulator to gather comprehensive information about lending practices, collateral valuation, and even ownership structures of companies receiving loans from banks.

According to financial analysts, the Fed is essentially creating a roadmap for the shadow banking sector. By leveraging the data from traditional banks, they’re attempting to piece together the puzzle of systemic risks that might be hiding in less regulated corners of the market.

The timing of this initiative is crucial. With interest rates remaining higher for longer than many market participants expected, there are growing concerns about potential vulnerabilities in areas such as private credit and lending to private funds. The shadow banking sector, now estimated to be worth trillions of dollars, plays a significant role in the broader financial ecosystem.

However, experts caution that while this is a step in the right direction, it may not provide a complete picture.

See Related: Italy to Introduce 26% Capital Gains Levy On Cryptocurrencies In 2023

US Banks Exposure And Private Credit Market

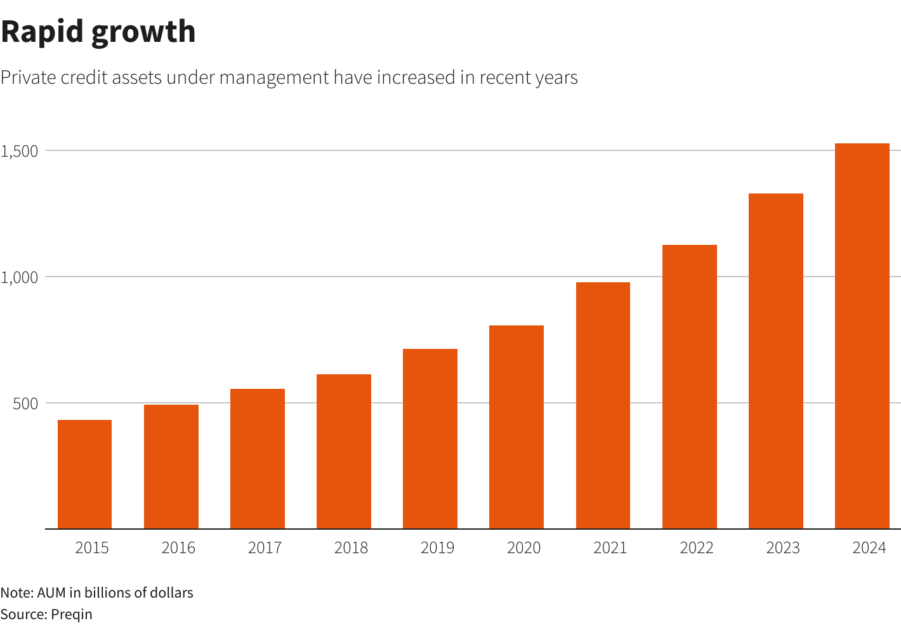

Indeed, the Fed’s estimate of U.S. banks’ total exposure to non-depository financial institutions stands at $2 trillion as of the end of 2022. Yet, the private credit market alone is now valued at $1.5 trillion, according to data provider Preqin, highlighting the vast expanse of the shadow banking sector that may remain beyond regulatory purview.

Looking ahead, the implementation of these new rules could mark the beginning of a new era in financial regulation. If approved, banks could start reporting this detailed information by the end of the year or the first quarter of 2025. This data would then be incorporated into the Fed’s annual stress tests, providing a more comprehensive assessment of the financial system’s resilience.

As we move forward, the financial world watches with bated breath. Will these new measures be enough to prevent potential crises brewing in the shadows? Or will regulators need to develop even more innovative approaches to keep pace with the ever-evolving financial landscape?

One thing is clear: in an increasingly interconnected financial world, understanding the risks posed by shadow banks is no longer optional.

As we venture into this new regulatory frontier, only time will tell if these measures will be sufficient to shed enough light on the shadows of our financial system. What’s certain is that the Fed’s latest move signals a significant shift in regulatory approach, one that could reshape the future of financial oversight for years to come.