U.S. Inflation data and Federal Reserve policy meeting will be at the centre of attention in June 2023, and according to estimates, consumer prices are likely to have cooled slightly on a month-over-month basis in May. Still, core prices are expected to have remained sticky.

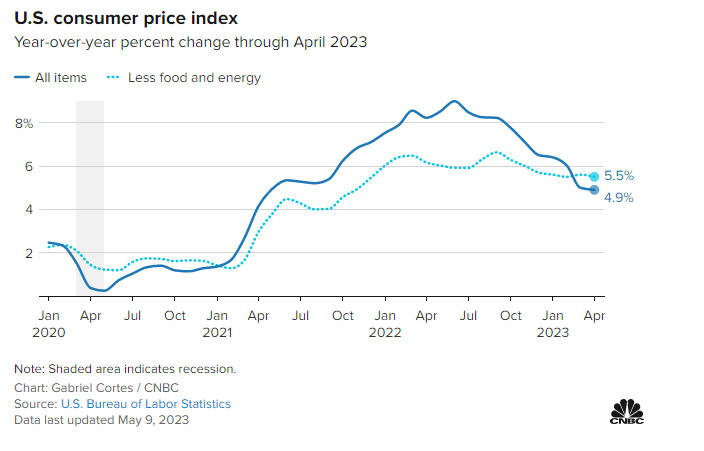

The U.S. Bureau of Labor Statistics will release its May inflation report next Tuesday, and the latest report showed that the Consumer Price Index (CPI), which measures prices that urban consumers pay for a basket of goods and services, slipped to 4.9% in April from 5.0% in March. The CPI reading has cooled considerably since peeking out around 9% in June 2022, which suggests that the Fed’s campaign to quell inflation is working.

However, a core measure that strips out volatile food and energy prices remained flat every month in April. Still, the U.S. Labor Department also reported that the Producer Price Index cooled more than expected in April. Producer Prices Index measures the prices U.S. companies get for their goods and services at the figurative factory door shed an encouraging 0.3 percentage point to 3.4% year-on-year.

Signs of cooler inflation would probably support a rate pause in June, but investors should keep in mind that inflation remains far above the Fed’s target, and the path to 2% will be bumpy. On the other side, the Fed will not hesitate to raise rates again if inflation data surprised strongly to the upside.

CME Group’s Fedwatch tool reported that the market is currently pricing a 76% chance that the U.S. central bank will keep rates unchanged at its June 13-14 meeting; however, there are 50% odds of another 25-basis-point rate hike in July. Starting in March 2022, the U.S. Federal Reserve has enacted ten consecutive interest rate increases totalling five percentage points. However, strong jobs data signalled that the Fed’s monetary tightening is still not cooling the world’s largest economy enough.

The federal funds rate is now in a range of 5% to 5.25%, which is the highest level since 2006 year and in the days ahead, stock and cryptocurrency markets will be hypersensitive to any FED comments. Paul Nolte, senior wealth adviser and market strategist at Murphy & Sylvest, added:

“U.S. stocks rallied last week on hopes that the U.S. central bank could skip an interest rate hike this month, while investors welcomed a Washington deal that avoided a catastrophic debt default. The market is on pause now until we get to the Fed meeting and the inflation data.”