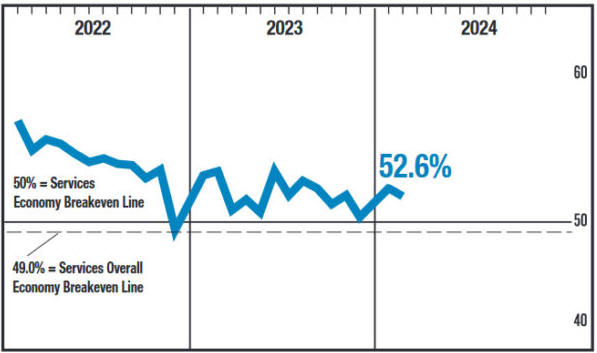

US stocks extended losses on Tuesday after the data showed that the ISM Services PMI in the United States decreased to 52.6 points in February from 53.4 points in January of 2024. Economists expected a dip to 53 and it is also important to mention that the ISM services employment index fell 2.5 points to 48.

However, a services PMI beyond 49 percent usually indicates an expansion of the overall economy which suggests the February Services PMI shows the overall economy is growing for the 14th consecutive month after one month of contraction in December 2022.

The past relationship between the Services PMI and the overall economy indicates that the Services PMI for February (52.6 percent) corresponds to a 1.2-percent increase in real gross domestic product (GDP) on an annualized basis

Anthony Nieves, Chair of the Institute for Supply Management Services Business Survey Committee, said that the slight decrease in the rate of growth in February is a result of faster supplier deliveries and the contraction in the employment rate. Anthony Nieves added:

“The majority of respondents are mostly positive about business conditions. Respondents remain concerned about inflation, employment, and ongoing geopolitical conflicts.”

See Related: GBTC Price Prediction after Judges Raised Hope for Investors In Favour Of Grayscale

Federal Reserve And Economy Evaluation

Federal Reserve Chair Jerome Powell is scheduled to testify before Congress on Wednesday and Thursday, where he will share his evaluation of the economy and potentially offer new insights into the timing of potential rate cuts.

Markets have rallied this year on bets that the Fed would start trimming rates in May but some Federal Reserve governors warned in the last couple of weeks that the interest rate cuts expected by the market in the first half of the year may have been premature.

Some economic analysts said that the central bank became too focused on inputs after misreading inflation in 2021 and they warned that the Fed risk a recession if it cut rates later than June. So far into 2024, the Fed funds rate has remained paused at a range of 5.25%-5.50% and many central bank officials want to see a clear disinflationary trend in the data before cutting rates.

Simultaneously, the increase in geopolitical uncertainties presents an extra hurdle and amplifies the possibility of unexpected risks in both markets and economic outcomes. Given these factors, the outlook is expected to remain cautious as long as interest rates remain significantly restrictive and the looming presence of geopolitical risks persists.