The prospect of Donald Trump returning to the White House is sending shockwaves through the global banking sector, with European lenders bracing for an even steeper climb to match their American counterparts’ profitability, Reuters reports.

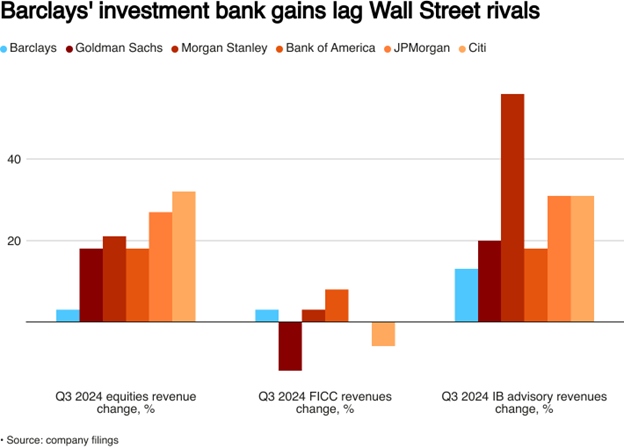

The stark contrast between U.S. and European banking trajectories, already evident since the 2008 financial crisis, looks set to widen further. While European banks have struggled with meager profits and sluggish economic growth, their American rivals have flourished, particularly in investment banking where they’ve captured significant market share from retreating European institutions.

The numbers tell a compelling story: European banking shares have declined 10% since early 2010, while U.S. banks have seen their value more than triple. The European Central Bank reports that eurozone banks’ return on equity hovers around 5%, less than half of their U.S. peers’ 10%.

The market’s immediate reaction to Trump’s victory was telling. Banking giants JPMorgan, Goldman Sachs, and Morgan Stanley saw their shares surge, while the European banking index dipped more than 1% this week.

See Related: Wall Street Rises As Key Consumer Confidence Gauge Shows Gains

European Policymakers And Banking Regulations

European policymakers are already preparing for the shifting landscape. In a notable development, Swiss Finance Minister Karin Keller-Sutter and British counterpart Rachel Reeves recently discussed the implications of potential U.S. banking deregulation during bilateral talks.

Industry experts anticipate that a Trump administration could significantly reshape the U.S. banking sector. Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors, suggests that beyond rolling back parts of the Dodd-Frank law, a less restrictive regulatory environment could spark increased merger and acquisition activity, benefiting U.S. investment banks.

However, it’s not all doom and gloom for European banks with significant U.S. operations. Filippo Maria Alloatti, Head of Financials Credit at Federated Hermes, points out that institutions like Barclays, Deutsche Bank, and UBS could see “positive impacts” from their American exposure.

Looking ahead, the global banking landscape appears poised for significant transformation. While U.S. banks may benefit from potential deregulation and tax cuts under a second Trump presidency, European banks might find themselves forced to innovate and adapt to remain competitive. This could catalyze much-needed consolidation in the European banking sector, already evidenced by recent merger discussions between major players like UniCredit and Commerzbank.

The coming years may well determine whether European banks can find ways to narrow the profitability gap with their U.S. rivals or if the Atlantic divide in banking performance will continue to widen. As regulatory frameworks diverge further, the challenge for European policymakers will be maintaining financial stability while ensuring their banking sector remains internationally competitive.

This will be a crucial test for both European banks and regulators, potentially reshaping the global financial services landscape for decades to come.