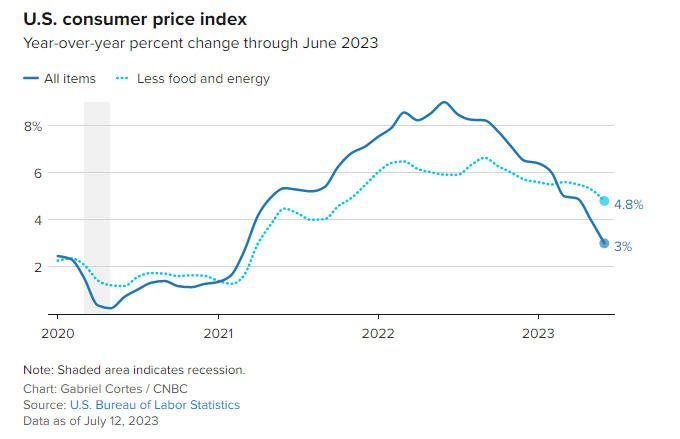

The U.S. Bureau of Labor Statistics released its June inflation report this Wednesday, and the report showed that the Consumer Price Index (CPI), which measures prices that urban consumers pay for a basket of goods and services, rose 0.2% in June compared with May’s 0.1% growth, but landed below the 0.3% consensus. In the 12 months through June, the consumer prices (CPI) advanced only 3.0%, and it is important to say that this was the smallest year-on-year increase since March 2021 and followed a 4.0% rise in May.

The CPI reading has cooled considerably since peeking out around 9% in June 2022, which suggests that the Fed’s campaign to quell inflation is working well. Another positive information is that a core measure that strips out volatile food and energy prices was 0.2% every month in June, halving from the 0.4% growth rate in each of the three months prior.

The Fed may debate whether to hike the policy rate further based on the new inflation data. However, Ryan Sweet, the Chief US Economist at Oxford Economics, thinks that the cooler-than-expected inflation report will not stop the Federal Reserve from raising its policy rate by 25 basis points at its meeting this month. According to a survey from the CME Group, markets are pricing a 90% chance that Fed policymakers will raise interest rates by 25 basis points at the next Federal Reserve meeting scheduled for July 26.

Wall Street is in celebration mode after a sharper-than-expected deceleration of inflation, but it remains above Powell & Co’s average annual 2% target. However, there is a great probability that interest rates will stay unchanged at the September, November, and December meetings. Brian Jacobsen, chief economist at Annex Wealth Management, said:

“U.S. consumer prices rose modestly in June and logged their smallest annual increase in more than two years as inflation continued to subside. Even though the Federal Reserve has probably already talked itself into a corner needing to hike at the July meeting, it may be the last one for this hiking cycle.”

Starting in March 2022, the U.S. Federal Reserve has enacted ten consecutive interest rate increases totaling five percentage points, and the next Federal Reserve policy meeting will be at the center of attention in July 2023. The federal funds rate is now in a range of 5% to 5.25%, which is the highest level since the 2006 year, and in the days ahead, stock and cryptocurrency markets will be hypersensitive to any FED comments.